Picture: Designed by Freepik

Get The Important Insights

With an impressive CAGR of 9%, the global aesthetic Botox market is expected to exceed 6 billion USD in 2026. Despite its robust growth, this segment is not without challenges, as the preferences among aesthetic medicine patients continue to evolve. However, amidst these challenges lie significant growth opportunities, particularly in emerging markets, which paint a promising outlook for the industry.

The Global Aesthetic Botox Market Landscape

Injectable treatments have emerged as the undeniable blockbusters of the aesthetic medicine industry, with approximately 20 million individuals worldwide benefiting from these procedures annually, evenly split between fillers and toxins. The market for these treatments is on a continuous upward trajectory, boasting an impressive global CAGR of 9%, mainly due to the increasing desire for minimally invasive procedures.

Botulinum Toxin remains the most sought-after aesthetic procedure globally, with a staggering 9,221,419 procedures performed in 2022 according to ISAPS, comprising:

- 66.4% of all injectable procedures

- 48.9% of all non-surgical procedures

- 27.3% of all procedures

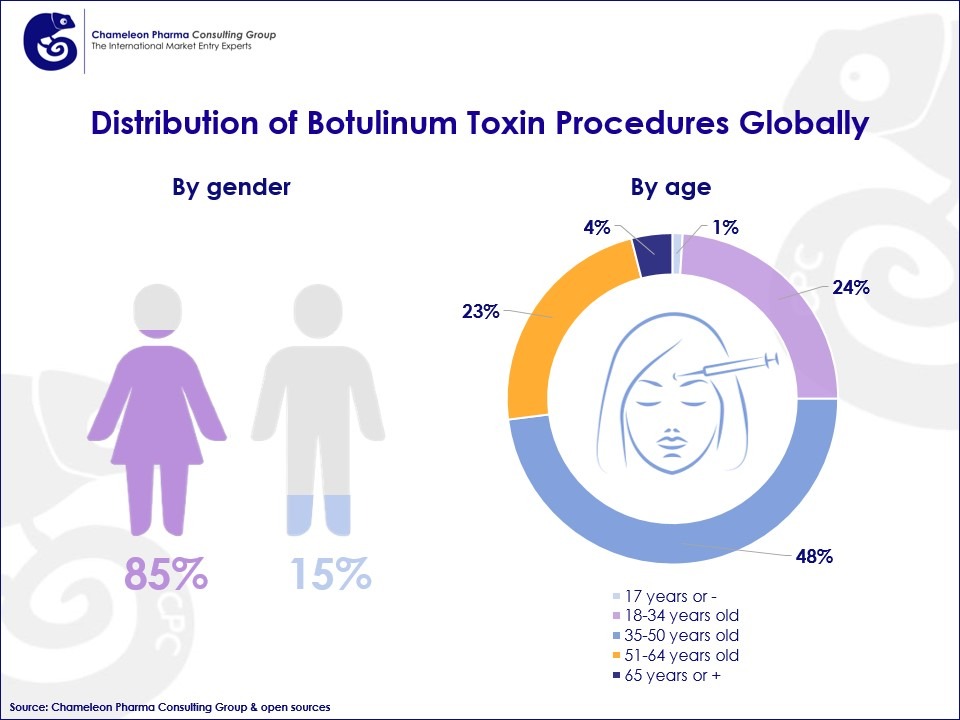

Notably, there has been a significant increase in the share of men undergoing Botox treatments, rising from 12.3% in 2018 to an expected 17.1% in 2025, reflecting a growing trend among male consumers in the aesthetic medicine market.

Figure 1. Distribution of Botox procedures by gender and age

The Botox’s Key Players and Markets

According to experts, in 2023, the Botox market in the Asia-Pacific region alone reached USD 1.2 billion, while in Latin America and Europe, it stood at USD 0.3 billion and USD 0.6 billion, respectively.

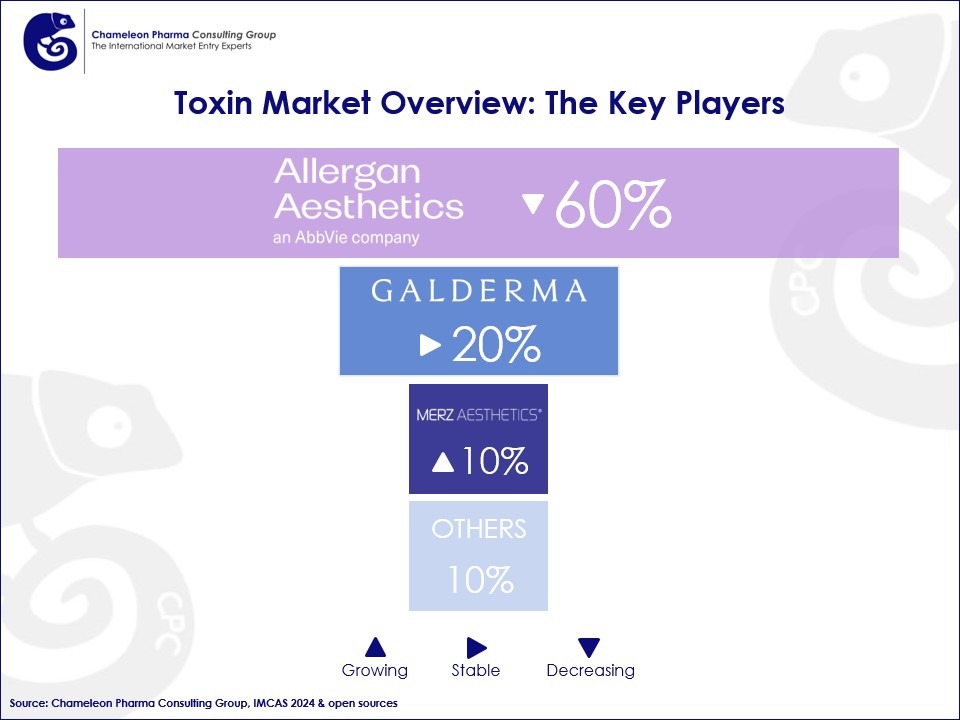

Figure 2. Toxin market overview: the key players

The global market is predominantly led by Allergan, with a slightly decreasing market share of around 60%. Galderma holds approximately 20% of the market, maintaining a steady position. Merz, with a 10% share, is experiencing growth. The remaining 10% is divided among other competitors. While Allergan remains the dominant player, Merz’s expanding market share indicates a changing competitive landscape.

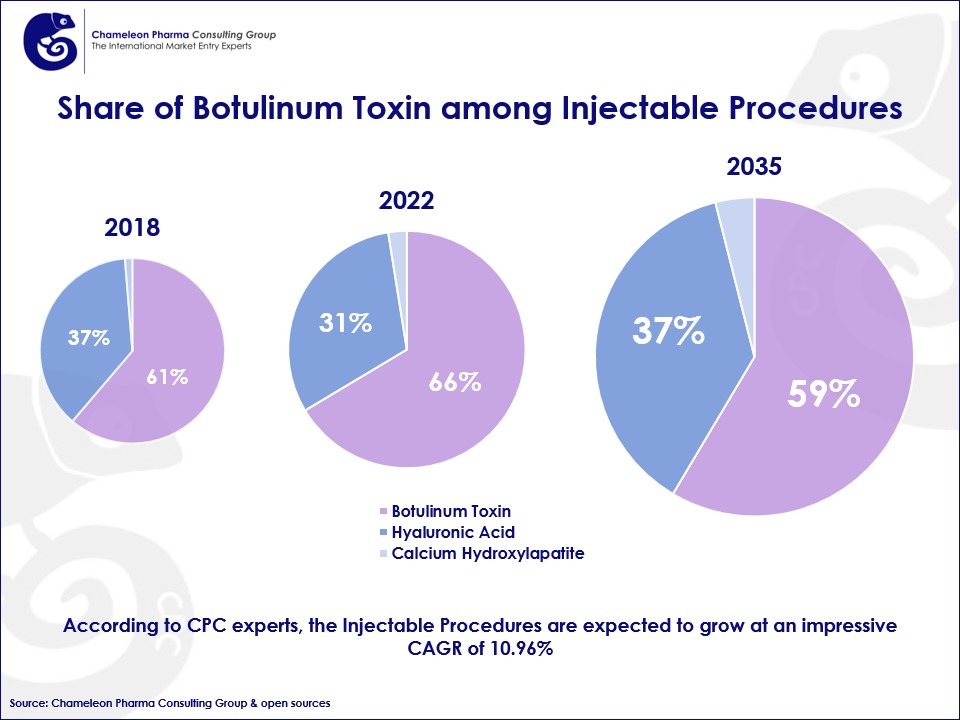

Figure 3. Share of Botox among injectable procedures

Botox maintains a dominant position in the global aesthetic market, with significant utilization across various countries. In the United States, Botox accounted for a staggering 87% of injectable procedures in 2022, representing over half of the total aesthetic treatments performed. Japan is the country that experienced the most significant growth in the proportion of Botox use among its injectable procedures these last years, reaching 84% in 2022.

Similarly, countries like Mexico, Germany, Brazil, and Colombia also demonstrate significant reliance on Botox for injectable treatments, with percentages ranging from 54% to 61%. However, there has been a recent decline in the proportion of Botox among injectable treatments performed in these countries, reflecting a growing preference for alternative treatments, like hyaluronic acid.

Opportunities and Future Outlook

The Botox market is poised for significant growth and expansion in the future, driven by various opportunities.

- Emerging markets in Asia-Pacific, Latin America, and Eastern Europe present promising opportunities fuelled by rising disposable incomes, growing consumer awareness of aesthetic treatments, and an expanding aging population.

- Diversification of indications beyond traditional wrinkle treatment creates opportunities for manufacturers to explore new medical and aesthetic uses, such as chronic migraine and hyperhidrosis, expanding the market reach.

- Technological advancements, including the development of new botulinum toxin types, longer-acting formulations, and modified neurotoxins, among others, could lead to increased competition from botox alternatives, potentially eroding market share and pricing power for established manufacturers. Novel delivery methods such as ultrasound or intradermal injections, also enable differentiation and capture of market share.

According to experts, Latin America, Asia-Pacific, and Europe are promising markets, with CAGR to 2026 ranging from 6.9 to 7.7%.

Check out other articles on the CPC website for further information about the Aesthetic medicine markets in Latin America, Asia-Pacific, and Europe.

Chameleon Pharma Consulting Group has more than 20 years of experience in providing support to companies looking to enter or expand in international aesthetic medicine, consumer health and pharma markets. With the expertise amassed from more than 160 international projects and 22 experts around the world, CPC Group offers:

- Systematic product and country analysis;

- Systematic local partner identification;

- Regulatory and registration assistance.