Photo by: Designed by Flickr

Get The Important Insights!

The aesthetic medicine market in Spain has experienced remarkable growth in recent years, reflecting a growing demand for cosmetic procedures and treatments. With the 10-15 % growth rate, the estimated turnover for the aesthetic medicine market in Spain in 2030 would be around €8 bln. This growth is driven by a number of factors, including an increasing demand for non-invasive procedures, a growing awareness of the benefits of aesthetic medicine, and a more favorable regulatory environment.

Market Overview

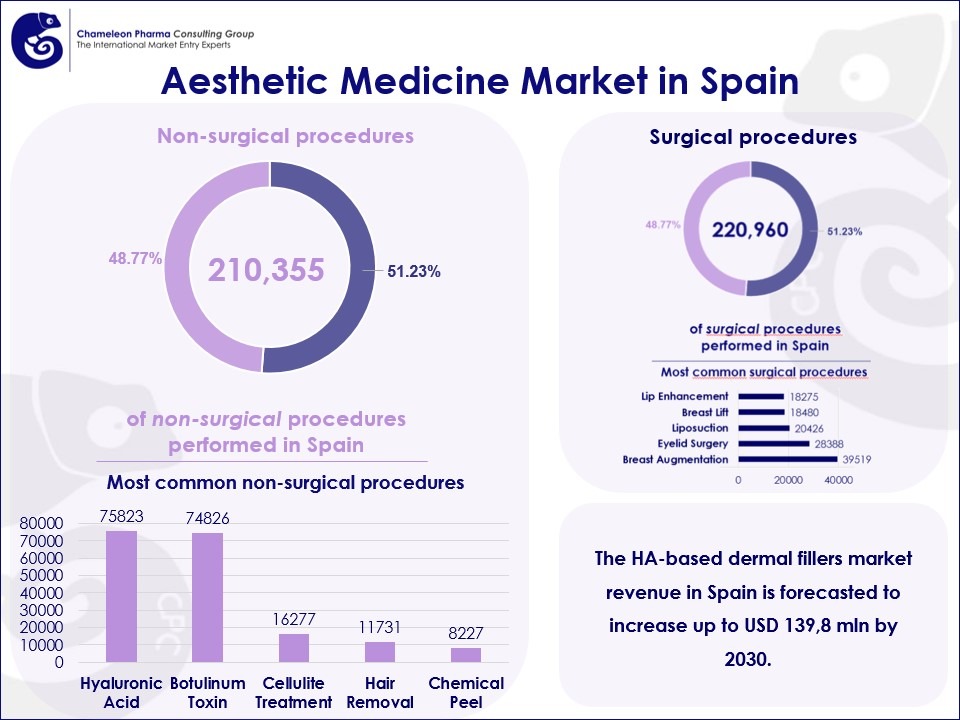

According to data from the International Society of Aesthetic Plastic Surgery (ISAPS) 2022 report, the total number of aesthetic medicine procedures in Spain in 2021 surpassed 431,315, indicating a significant demand for aesthetic enhancements.

According to the National Congress of the Spanish Society of Aesthetic Medicine (SEME), around 40% of Spaniards have received medical aesthetics treatments, with 71% of women and 28% of men undergoing procedures to enhance their appearance.

Figure 1: Aesthetic Medicine Market in Spain: Most Common Surgical and Non-surgical procedures

The majority of cosmetic procedures in Spain are performed in clinics (54%), 34% of treatments are conducted in beauty salons, and 12% in free-standing surgicenters. Aesthetic medicine procedures in Spain are performed by aesthetic doctors and plastic surgeons, with the monthly average number of aesthetic procedures being around 100 for both.

The aesthetic injectables market is a significant driver of the overall market growth in Spain, projected to increase at a CAGR of 6,2% between 2023 and 2030, reaching USD 140 mln. The injectables market’s key players include Allergan Aesthetics, Galderma, Merz Pharma, Sinclair Pharma, and Teoxane. Aesthetic injectables such as botulinum toxin type A and hyaluronic acid fillers are among the most sought-after treatments, addressing concerns such as facial wrinkles, volume loss, and facial contouring.

Aesthetic Medicine and Aesthetics Industries – Friends or Foes?

The ongoing convergence of aesthetic medicine and professional aesthetics has sparked different opinions on this topic. Several Spanish industry experts underscore the significant opportunity that aesthetic medicine presents for beauty centers looking to evolve, retain their customers, and generate more profit. According to them, clients in Spain increasingly seek instantaneous results with long-lasting effects, driving demand for a fusion between aesthetic medicine and professional aesthetics. This means the following:

- Beauty centers that invest in aesthetic medicine services are experiencing substantial growth, particularly during the typically slower winter months.

- Failure to embrace aesthetic medicine can lead to stagnation, as clients may seek out providers offering a comprehensive range of services.

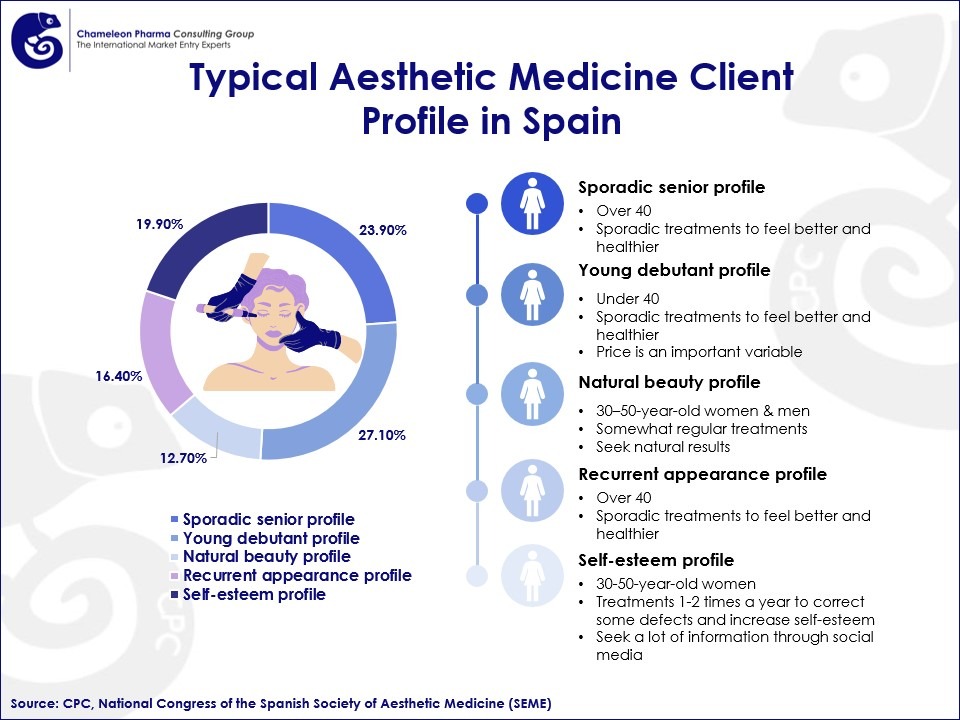

Additionally, aesthetic medicine experts in Spain indicate that there has been a shift in the demographic profile of aesthetic medicine clients:

- Treatments are now sought by a wider range of age groups, including individuals in their 20s. However, the majority of procedures are still performed on patients over 40 years old.

- Clients are more informed and discerning, seeking personalized treatments with natural results, quality, effectiveness, safety, transparency, and professionalism.

As aesthetic medicine continues to integrate into the beauty industry, treatments will become more personalized and accessible, requiring beauty centers to adapt and expand their portfolio of products and services to remain competitive. Due to this driving force, the number of aesthetic medicine clinics in Spain increased by around 20% yearly.

Figure 2: Typical Aesthetic Medicine Client Profile in Spain

Medical Tourism and International Rankings

Spain also attracts a significant number of medical tourists, with an average of 17.5% of patients attending from other countries (5th place worldwide). Popular source countries include the UK, France, and Colombia, reflecting Spain’s reputation as a hub for aesthetic procedures.

Overall, the aesthetic medicine market in Spain is a growing and dynamic market with many opportunities for businesses that can adapt to the latest trends and challenges.

Chameleon Pharma Consulting Group has more than 20 years of experience in providing support to companies looking to enter or expand in international aesthetic and pharma markets. With the expertise amassed from more than 300 international projects and 22 experts around the world, CPC Group offers:

- Systematic product and country analysis;

- Systematic local partner identification;

- Regulatory and registration assistance.