This is the first of a three-part series analyzing the OTC and Phyto market’s prospects through 2035.

Get The Important Insights!

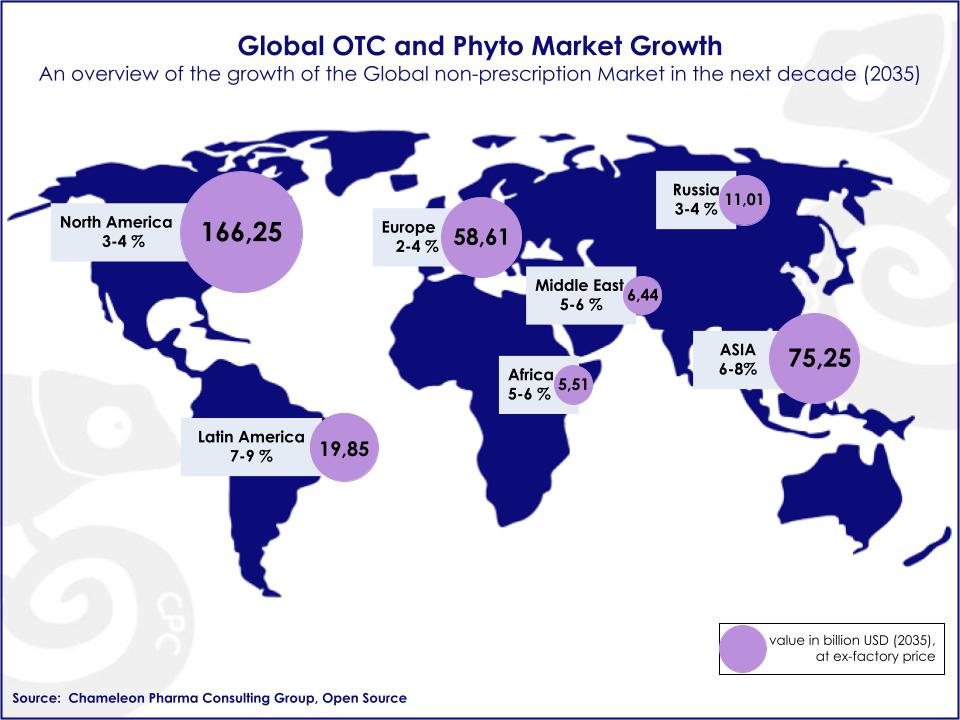

Global OTC and Phyto ex-factory sales are projected to reach 334 billion USD in 2035, opening a broad way for active OTC players as well as for new entrants. This article aims to provide insights into the top potential OTC markets and segments, in order to help you hone your strategy for the next 10-15 years.

General Evolution of the Global OTC and Phyto Market

In the period between 2020-2023, the self-medication markets around the world began recovering slowly from the impact of the COVID-19 pandemic. Entire healthcare systems were focused on COVID-19 treatment (including vaccines), which prevented consumers from purchasing OTC drugs in pharmacies. Starting in 2024, the global OTC market is expected to expand with a stable growth rate of roughly 5%. Although North America and Europe continue to hold the largest slice of the world’s OTC market, emerging regions such as Latin America and Southeast Asia are developing at a much faster growth rate.

Map: Global OTC and Phyto Market Growth (2035 prospect)

LATIN AMERICA FOCUS

LATAM’s ex-factory sales for the OTC industry are predicted to hit 19,85 billion USD by 2035, with a CAGR of approximately 7,34% between 2030-2035.

Weight Loss and Diet Products Contribute to the Largest Share of the OTC Market

This segment is likely to acquire a quarter of the region’s OTC market. The explanation for this lies in the adoption of the western lifestyle with a rise in junk-food consumption. However, due to the increased public awareness of this unhealthy lifestyle, weight loss and dieting products are being used more prophylactically than therapeutically in this region.

Other factors: Expanding National Healthcare Expenditure, Availability of OTC Sales Channels, and Changes in Cultural Attitudes.

LATAM is facing the problem of a growing geriatric population, meaning national healthcare expenses need to be enlarged to continue to ensure the quality of life for the citizens. Additionally, the rise of innovative OTC product promotions and accessibility via supermarkets have also had a strong impact on the region’s OTC total sales. More importantly, the change in cultural attitudes towards self-medication for mild symptoms as opposed to prescription drugs has also contributed to this trend. Phyto products have grown much faster than chemical consumer health brands. This trend suggests that Latin American consumers are willing to pay premium prices for herbal drugs from Europe.

Brazil and Mexico as the Region’s Leaders

Brazil is the most enticing market for OTC products among the LATAM countries. Its OTC and Phyto ex-factory size is forecasted to be valued at approximately9,74 billion USD in 2035. In Brazil, the impact of the COVID-19 pandemic has resulted in the formation of a reassessment of category stocking, which suggests that retailers and wholesalers consider consumers’ behavior and adjust the portfolio accordingly. The reason is that the prevention and basic healthcare segments have shown strong growth in recent years, especially in vitamins, minerals, and supplements (VMS).

Meanwhile, Mexico–another emerging market–is growing rapidly and is projected to reach a valuation of 5,08 billion USD in ex-factory sales by2035. Mexico is one of the most densely populated countries in the world. Due to recent developments, the standard of living has improved tremendously in the last few years. Life expectancy, as well as the number of persons aged over sixty-five, has increased, thereby intensifying the demand for self-medication and Phyto products. Consumer prices in Mexico are 30-40% higher in specific segments, e.g. cough and cold, UTI, and women’s health compared to Europe. Moreover, due to new regulations, the healthcare system has also become much more patient-friendly.

Rx-to-OTC Switch

The switch from Rx-to-OTC has been happening rapidly all over the global healthcare industry. In order to get OTC status, the medicine must be effective and include comprehensive labels to ensure it is used properly. However, the most important prerequisite for the switch is the safety of the drug.

Entering different local markets requires deep knowledge of each country’s characteristics. We at Chameleon Pharma Consulting Group, with expertise via more than 300 international projects, can provide you with valuable insights into mature and especially, emerging markets. And we are happy to assist you in internationalizing your business. Contact us today!

Photo by Michał Parzuchowski on Unsplash

Photo by Jonatan Lewczuk on Unsplash