Photo by Eduardo Garcia on Unsplash

The OTC and Rx market in Peru is projected to surpass 2.89 billion USD in ex-factory sales by 2035 according to market data analyzed by CPC. This steadily expanding market presents significant growth opportunities, primarily attributed to two key factors: the persistent undersupply of medications in certain localities and the ongoing supply chain issues affecting state-run establishments responsible for providing medications to patients in Peru. Consequently, major pharmacy chains play a pivotal role in the industry.

The OTC and Pharma market in Peru has maintained good growth over the past years. However, there is still room for enhancement with the introduction of consumer health and pharma drugs that are relevant to the needs of patients in Peru.

When it comes to pharma retail outlets there are two main groups: private stores and state-run retail outlets

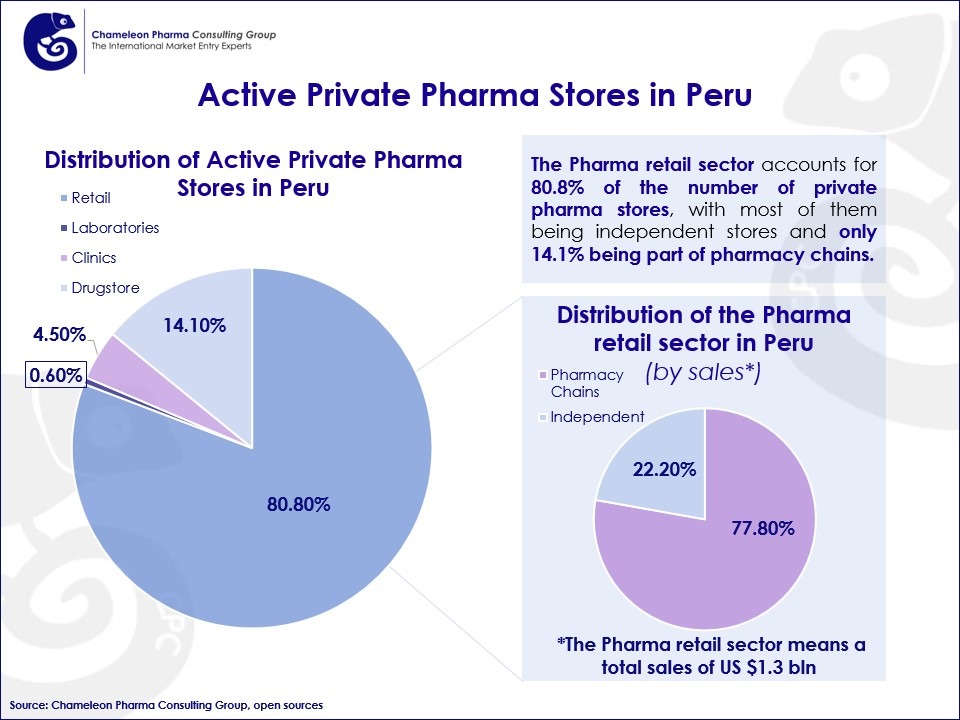

In total, there are 34,107 active stores in the Selfmedication and Pharma industry in Peru, divided into four main groups, all of which sell drug products:

- Retail sector (Bot y far): This sector comprises 28,133 stores in total. In these establishments, pharma products, medical devices, or healthcare products are dispensed and sold to the final consumer, or pharmaceutical preparations are made. In order to be called a pharmacy, it must be owned by a pharmacist; otherwise, it will be called an Apothecary.

- Drugstores (DRG): There are 4,915 drugstores in total, dedicated to the import, export, selling, storage, quality control, and distribution of pharma products, medical devices, or healthcare products.

- Clinics (FARES): There are 868 clinics in Peru, providing a wider range of medical services, diagnosis, treatment, and sometimes preventive care. FARES are often associated with pharmacies or drugstores and may operate within the same building or complex.

- Laboratories (ccc): There are 192 laboratories in total. These are the facilities specializing in diagnostic testing and analysis

Breaking it down further, the retail sector represents 80.8% of all private pharma stores. Drugstores, clinics, and laboratories combined account for the remaining 19.2%.

Within the retail sector, there are primarily independent stores and stores belonging to pharmacy chains. However, in terms of sales, pharmacy chains dominate the market, accounting for 77.8% of the market share in value, with only 3,967 pharmacies in number of stores.

Figure 1. Active private pharma stores in Peru

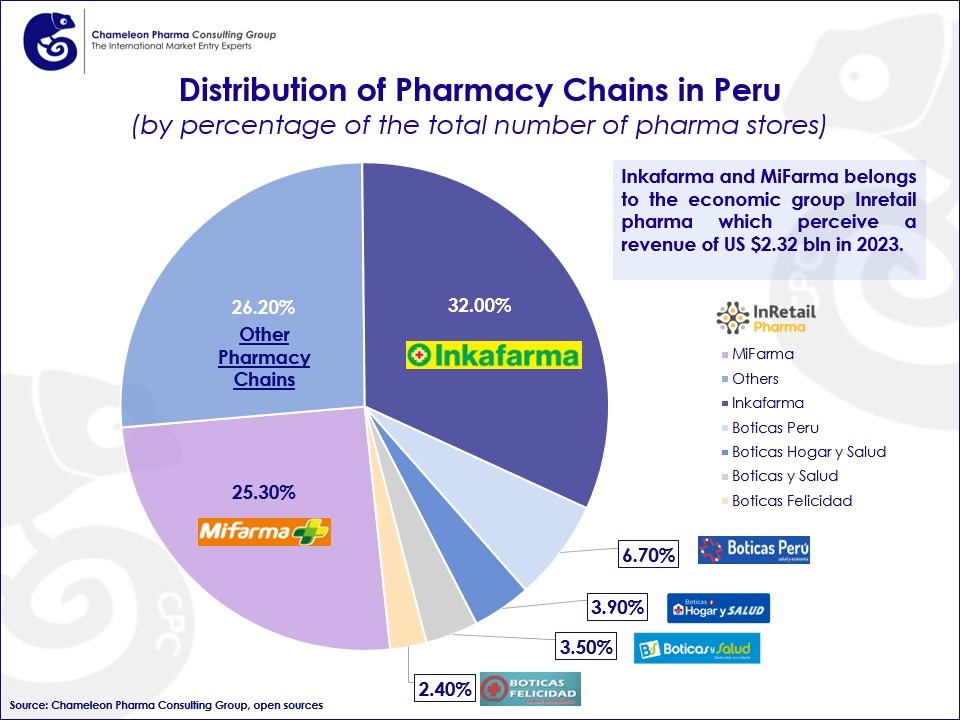

The leading pharmacy chains with the highest number of pharmacies per chain in the Peru pharma and OTC market are:

- Inkafarma: 1,269 pharmacies

- MiFarma: 1,005 pharmacies

- Boticas Peru: 266 pharmacies

- Hogar y salud: 153 pharmacies

- Boticas salud: 140 pharmacies

- Boticas Felicidad: 95 pharmacies

Figure 2. Distribution of the leading pharmacy chains in Peru by number of stores

Among the leading pharmacy chains, InkaFarma and Mifarma are the ones with the largest presence and belong to Inretail Pharma, a Peruvian economic group.

According to the Peruvian National Association of Drugstore Chains, 98% of households utilize generic medications due to their lower costs. Given the limited supply of drugs by public establishments, Peruvian patients are increasingly resorting to out-of-pocket expenses and procuring medications from private pharma establishments year after year. Therefore, new self-medication and generic drugs launch strategies should take this segment into account. Furthermore, the key players in Peru’s healthcare industry are constantly striving to expand their reach to new Peruvian localities through the establishment of active outlets.

Taking this into account, the entry of self-medication and generic drugs, as well as innovative products, will be readily embraced and promoted by key industry players who are constantly striving to expand their reach to new Peruvian localities through the establishment of active outlets.

Leveraging a well-established global network and decades-long experience accumulated through numerous successful projects, Chameleon Pharma Consulting Group offers comprehensive support across diverse healthcare segments. Our expertise encompasses Consumer Healthcare, Medical Devices, Rx, OTC products, and Cosmetics. We partner with clients to develop and execute international strategies, navigate complex regulatory landscapes, facilitate GMP certification, and ensure a smooth market entry for the Peruvian and broader Latin American markets.