Get The Important Insights!

When introducing a new healthcare product to the market, a thorough understanding of the regulatory institutions’ processes and requirements is key to success. This article aims to give you important insights into the registration path in Vietnam.

Insights on Vietnam’s Consumer Health, MD, and Rx Drugs Market:

With a growing population of over 100 million inhabitants, Vietnam is one of the most promising healthcare markets in Asia. The Vietnamese OTC & ETC (Rx) market is forecasted to reach US$25,8 billion (ex-factory) in 2035 with an annual growth rate of 10-12%(2025-2035). Most recently, there have been some significant shifts that are making Vietnam a more compelling option, helping it to rise to the top of the list for international companies that are looking to expand their business into emerging markets.

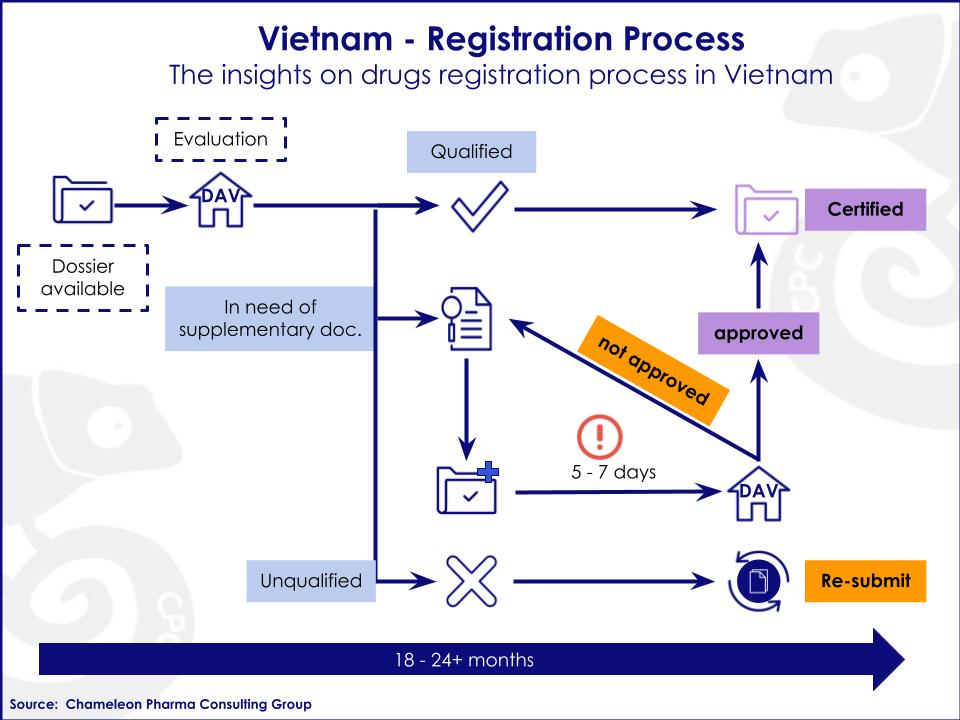

Vietnam registration process: insights on drugs registration process in Vietnam

Market Drivers

There are several factors for this development:

- Vietnam currently has the fastest-growing middle-class population in Southeast Asia, boosting the demand for high-quality healthcare services and products, with a particular preference for those with European and American origins.

- The hospital systems and health insurance providers are expanding, with the goal of covering 95% of the population with a universal healthcare service by 2025.

- The European Union Vietnam Free Trade Agreement (EVFTA) allows foreign companies to import and sell self-medication and prescription products to Vietnamese distributors and wholesalers, as well as exempt the additional testing and certification for certain products which are already certified in the EU.

Vietnam’s production capacity is still unable to meet its domestic pharma drug demand. About 90% of all OTC and pharma products are imported. The import is classified by a tax system specific to the origin of the importer. Having this in mind, OTC and pharma products coming from the EU region receive the lowest import tax rate.

The Pharmacovigilance Institutions of Vietnam:

The Drug Administration of Vietnam (DAV) is responsible for drug regulation in the country. Meanwhile, the Department of Medical Equipment and Health Works (DMEHW) is the country’s medical device regulator. All consumer health, MD, Phyto, and Rx drugs in Vietnam require both product approval and a separate import permit from the DAV. Only selected medical devices require approval for marketing. For food supplements, the regulatory body is the Vietnam Food Administration (VFA). The DAV, DMEHW, and VFA are all units under the Ministry of Health (MOH), known as “Bộ Y Tế”.

The Drug Regulatory Process:

- The applicant prepares the dossier and submits it to the Drug Administration of Vietnam (DAV).

- The administrative department classifies the application and waits for the evaluation in order to forward it to the corresponding subcommittees.

- The subcommittees evaluate the dossier and report the results to the DAV.

- The DAV then informs the applicant if the dossier has been rejected, approved, or is in need of supplementation.

- Approval: The DAV will issue a visa number for the approved dossier.

- Requirement of supplementation: The submitted supplementing documents will need to be reviewed by the DAV with the Advisory Council. The DAV will then decide whether the dossier meets the requirements for approval or not.

- Rejection: The applicant will need to re-submit the entire dossier again.

The process seems easy and straightforward, but there are some points that manufacturers–especially foreign ones–should keep in mind:

- The time frame to process a submitted dossier is generally 18-24+ months. But if necessary, the applicant will have to provide the supplementary documents within a short period of time (usually 7 working days).

- All documents will need to be translated into Vietnamese.

- The dossier will need to be arranged in an organized template that includes separate must-have sections, such as a bioequivalence study or GMP-conformity assessment.

With the expertise amassed from more than 150 international projects and 22 regulatory experts around the world, CPC Group can give you strong and reliable support, in case you are overwhelmed by registration processes. Contact us and we will assist you with a successful market-entry plan and registration strategy.