Get The Important Insights!

2021 was a record year for venture financing in the OTC, pharma and medical device industry, with US$86 billion invested in venture-backed private healthcare companies in the United States and Europe–a 65% increase over 2020, and a 153% increase over 2019; and the trend is expected to continue uninterrupted well into the next decade.

Indeed, many venture capital companies regard the post-pandemic era as the start of a multiyear opportunity in healthcare innovation, rather than a temporary bubble.

Venture Capital Investment Trends

COVID-19 has been a catalyst for healthcare innovation, sparking large-scale change, such as an increasing emphasis on virtual care delivery, greater relevance for mental health and well-being, and a drive for faster and preventive medication.

Venture capitalists (VCs) have been key to this prompt reaction and played a pivotal role in supporting and accelerating healthcare innovation by pouring investment into promising Rx, medical device and consumer health companies.

Here are some current and future trends:

- Health tech innovators have a unique role in the future of the healthcare industry due to their position at the crossroads of healthcare and technology.

- Companies that build products and solutions that address well-being and care delivery, such as remote patient monitoring and digital health, as well as secure data and interconnected platforms, are expected to receive the most venture financing in the future.

- VC investors will gently push both new and incumbent healthcare companies to bring new and innovative business models and consumer-centric strategies.

- Almost two-thirds of all venture capital investments in healthcare in 2021 have been later-stage. Investors are no longer focusing solely on finding the next healthcare unicorn, but they are now placing more value on targeting small and medium-sized healthcare innovators, with established value propositions and existing solid networks.

- Europe is definitely a market to keep an eye on. Not only are investors and healthcare innovators all over the EU, but also talent, promising businesses, and intelligent ideas. European venture investment activity in healthcare has been buoyant and will grow robustly.

- According to investors, scalability, and return on investment metrics will be the keys to success in the future of venture capital investments in healthcare, especially in Europe.

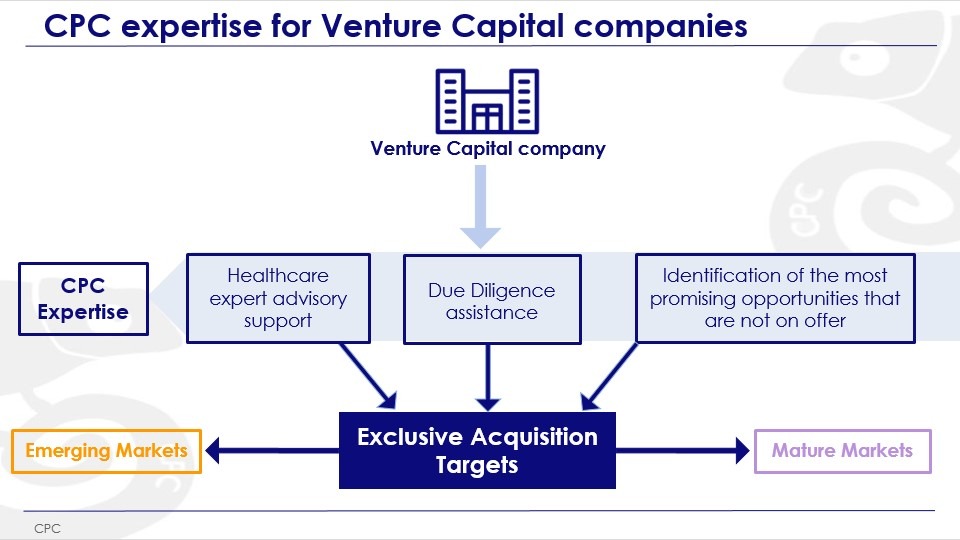

Infographic: CPC expertise for Venture Capital Companies

If your venture capital company or corporate branch is looking for exclusive acquisition targets or needs an expert perspective of the process, Chameleon Pharma Consulting Group can support you with healthcare expertise advisory support, due diligence assistance, and the identification of the most promising opportunities in consumer healthcare, in both emerging and mature markets, that may not be visibly on offer. Contact us today!