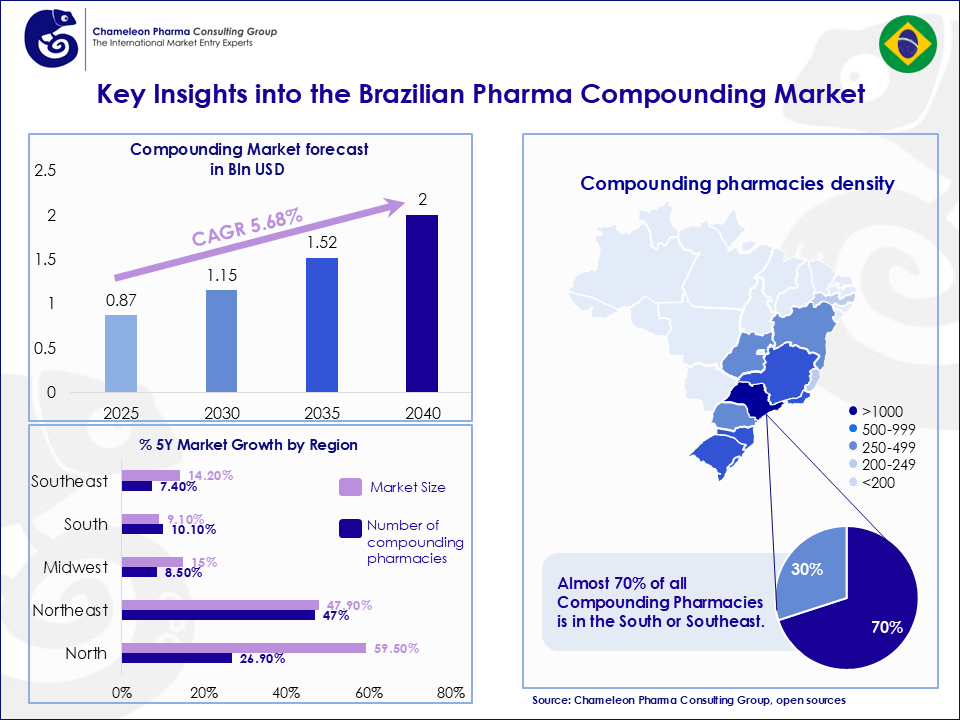

Brazil is recognized globally as the largest OTC and Pharma market in Latin America, with a Rx and OTC market projection of USD 129.86 billion by 2040. The size of the market creates opportunities for the growth of various profitable segments and niches, offering Rx, Consumer Health and Medical device companies the chance to boost their international sales. One among those promising segments is pharma compounding, whose market size is expected to jump from USD 780 Mln of 2023 to almost USD 2 Bln by 2040 with an expected CAGR of 5.68%.

Key Insights into the Brazilian Pharma Compounding Market

According to the Brazilian National Association of Compounding Pharmacies (ANFARMAG), the Brazilian market for pharma compounding is the most developed in Latin America, next to markets in countries such as Chile, boasting a market size more than twice the one of Argentina. As of 2023, Brazil is home for 8,711 small and local compounding pharmacies, with an expected number of 9,870 by the end of 2025. Their distribution is uneven across the country, with a higher concentration in the Southeast (∼ 50% of the total), and South (∼ 20% of the total), especially in the States of São Paulo, Rio de Janeiro, Minas Gerais, Paraná, and Rio Grande do Sul.

Their growth across Brazil was also uneven, with the highest being the Northeast, boasting a +47% increase in the number of compounding pharmacies in the 5 years between 2019 and 2023, while the more saturated Southeast only achieved a +7.4% in the same time span, relatively far from the +9.7% on the national level.

Figure 1: Key market insights about the size of the Brazilian Pharma compounding market

Among the reasons behind this rapid increase, we find the following:

- The general increase in demand is due to the rise in disposable income and increased awareness towards personalized care.

- Many market players want to establish themselves in emerging markets like the Northern and Northeastern regions of Brazil and exploit the low saturation of those markets.

- The widespread implementation of new business models like the franchise system, which allows for the replication of such a capital-intensive business model, e-commerce and kiosks in strategic hotspots like shopping malls.

Despite this, as of 2023 only 20.3% of all brands in the market own more than one pharmacy, indicating an extremely fragmented market ripe for consolidation.

By comparing the rise in the number of compounding pharmacies with the increase in market size, it becomes apparent that the North, Midwest, and Southeast have become drastically more profitable, both with a market size growth around twice the growth in the number of compounding pharmacies.

Competition Landscape of the Brazilian Pharma Compounding Market

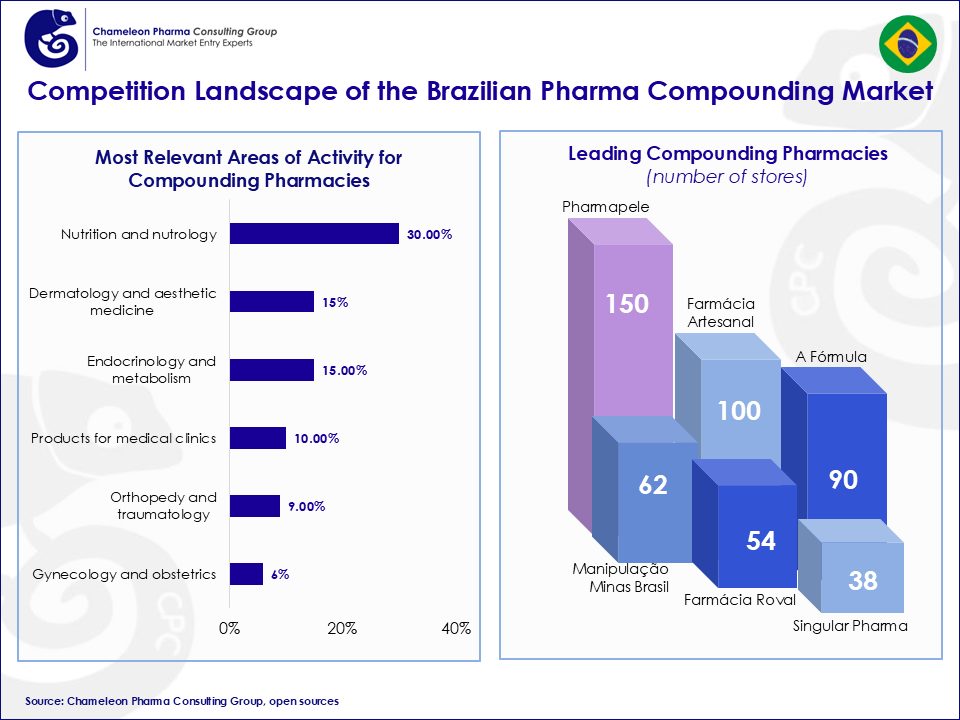

The most relevant product segments for compounding pharmacies in Brazil are the following:

- Nutrition and nutrology, for 30% of all compounding pharmacies.

- Aesthetic medicine and dermatology, for 15% of all compounding pharmacies.

- Endocrinology and metabolism, for 15% of all compounding pharmacies.

- Products for clinics, for 10% of all compounding pharmacies.

- Orthopedics and traumatology, for 9% of all compounding pharmacies.

- Gynecology and obstetrics, for 6% of all compounding pharmacies.

Compounded drugs for preventive medicine and veterinary use have also risen in popularity, although they remain a niche market.

Some of the biggest market players of the Brazilian pharma compounding market are:

- Pharmapele: with an impressive ∼150 compounding pharmacies under their name.

- Farmácia Artesanal: with ∼100 compounding pharmacies under their name.

- A Fórmula: with ∼90 compounding pharmacies under their name.

- Manipulação Minas Brasil: with ∼62 compounding pharmacies under their name.

- Farmácia Roval: with ∼54 compounding pharmacies under their name.

- Singular Pharma: with ∼38 compounding pharmacies under their name.

Figure 2: Competition landscape of the Brazilian pharma compounding market

Brazil’s pharma compounding market is rapidly expanding, fueled by rising disposable incomes and a surge in demand for personalized medicine. With a highly fragmented landscape and the highest growth in emerging regions like the Northeast, now is the perfect time for businesses to seize the opportunity before competition intensifies. Major players are already establishing their presence, and the market is ripe for consolidation.

Chameleon Pharma Consulting Group (CPC) has over 20 years of experience in supporting Pharma, OTC, Medical Devices, Phyto, and Aesthetic Medicine companies. Having established own offices & local hubs across Latin America, Europe, Asia, the US/Canada, the Middle East, and the CEE/CIS regions is another advantage of CPC. With this local network and expertise gained from 300+ international projects and a team of 25 experts we offer our clients:

- Business Development, M&A, and Due Diligence

- Market Entry & Expansion: Systematic product and country analysis, market reports

- Strategic Partnering: Identifying local partners, acquisitions, or setting up own offices

- Regulatory & Registration: for drugs, MD, Derma, Aesthetic Medicine, etc.

- Market Authorization & Compliance: Holding MAs, conducting pharmacovigilance

- Quality & Certification: GMP certification, pre-GMP audits

Contact us today for your individual request at service@chameleon-pharma.com!