In 2030, about 45% of sales for Consumer Heath & Pharma companies will be generated in international Emerging Markets.

Reason enough for Chameleon Pharma Consulting (CPC) to conduct its second international expert study of the MARCH countries (Mexico, America, Russia, and China). Hereafter please find a short summary of some of the main findings from the international Chameleon Pharma Market Study.

Introducing your own Consumer Health, Medical Device, Food Supplements, Cosmetics, or Rx products in additional growth markets in Latin America, Russia/CIS, Asia, Europe, or the USA, makes manufacturers less dependent on their home market. As shown by various CPC practical studies, if at least 70% of sales are generated in different regions of the world (outside the home market), a company becomes more resistant to crisis.

Since businesses all over the world have been heavily affected by the COVID-19 pandemic, the results of this year’s systematic CPC expert study are quite surprising. In many countries, the pandemic became an accelerator for online sales and even for relevant regulations change.

In order to better understand the international trends up to 2030, CPC selected the MARCH countries for this expert study:

- China,

- Russia,

- America (the USA) and

- Mexico.

China – The telehealth pioneer

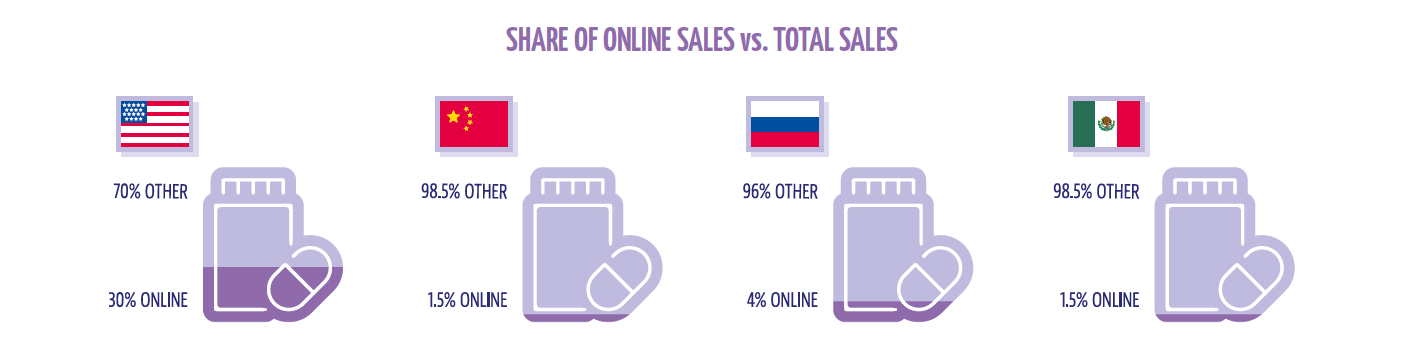

Despite the fondness for online shopping, online pharmacy sales in China are quite low, accounting for only 1.5% of total market sales on OTC, Cosmetic, and Food Supplements. This difference in the acceptance of online pharmacies is due to a series of scandals that decreased overall trust in the pharma industry and pharmacies in general. Additionally, the laws prohibiting sales of prescription drugs prevent online sales from occurring in this segment. Not to mention the fact that e-prescriptions and other electronic logistics that could facilitate the online purchase of medications is not yet in place in China. However, change is on the horizon and healthcare leaders should be prepared for it. Growing internet usage coupled with COVID-19 events have led to a sharp increase in the number of telehealth visits, allowing patients to speak with physicians without having to travel to the clinic or hospital. This uptake of telehealth could greatly shape the future of online pharmacies in China.

Russia – Pro-online law changes

In Russia, a type of “online pharmacy” has been in existence for many years. Online customers could order medicines online and have them delivered to any pharmacy of their choice. Following the new law on online sales of OTC products, that has been in force since May 2020, home delivery of OTC medicine has become possible. Delivering Rx drugs is still a possibility that is being discussed by the government, but due to the COVID-19 outbreak, it is highly probable that it will become a reality in the near future. In general, around 75% of consumers still prefer to go to their pharmacy of trust, while approximately 20% would rather call in advance or order online and then pick the medicine up at a pharmacy. The overall proportion of online sales is still only 4%, but we predict the number to rise quickly by a high double-digit number. However, compared to other countries, logistics are a challenge in Russia due to the large distances between the TOP 10 cities, something that we are not familiar within Europe.

USA – 80% e-prescriptions and rising!

Online sales in the USA account for 30% of total sales. This is partially due to regulations, which have allowed online sales of prescription medications for quite some time now. The regulatory environment combined with the rising adoption of e-prescriptions by many physicians contribute to the growing online sales of Rx products. Today, over 80% of all prescriptions written by physicians are e-prescriptions. For OTC products, online sales have been allowed for several years now, and most retail chains, supermarkets and online pharmacies offer delivery services in addition to simple mail order. Prices of medications in the USA vary greatly between pharmacies, and for many consumers who do not have enough insurance coverage, the price difference plays a major role in which pharmacy they choose to go to.

Mexico – Outstanding delivery speed

In Mexico, online pharmacy services are usually offered by existing pharmacy chains, but consumers still prefer to visit pharmacies in person or ordering their medicines by phone, rather than using online services. Mexico is quite famous for its quick medicine delivery and easy ordering process. Customers can expect home delivery of their medication within 3 hours (Rx & OTC). Another attractive feature unique to Mexican online pharmacies is that ordering Rx products is possible due to the fact that pharmacy couriers are also licensed pharmacists.

Summary, trends and outlook

With the speed at which the “new normal” and a kind of “forced digitalization” is progressing, several possible trends and future scenarios arise in the next 5-10 years for the various market participants.

- Doctors are increasingly offering telehealth and will in the future operate nationwide.

- E-recipes are overtaking traditional paper recipes.

- In the four MARCH countries, 40% of the total pharmacy market is already controlled by a few pharmacy chains – and the trend is rising.

- The individual local pharmacies must set themselves apart through individual service, local network, customer loyalty.

- “Forced digitization” is the “New Normal” – online pharmacies, telemedicine, mobile apps and many other digital options must be considered as a new standard by international management and regulators and must be included in international market entry projects.

- With and without digitalization, various studies have shown that companies are far more crisis-resistant if at least 70% of their sales are generated in different countries/regions of the world outside their home market.

Infographic by Larissa Hielscher, Serotonin Design