Get The Important Insights!

The medicine sales network in Vietnam is shaped by the complementarity between public and private entities. The prior is structured in four layers by the Vietnamese government. The latter is further divided between independent outlets and retail pharmacy chain stores.

The Hospital and Clinic Channels: For Specific Purpose

The Vietnamese public healthcare system is divided into four different levels. Each has specific health premises delivering care and selling medicines. It is organized as follows:

- Central level: 47 premises (hospitals)

- Provincial level: 530 premises (provincial general hospitals, specialized hospitals and sector hospitals)

- District level: 1.030 premises (district hospitals and polyclinics)

- Commune level: 11.000 premises (communal health centers)

These premises do not have the same duties and capacities. The communal health centers deliver basic care and sell the medicines from the LEMs (List of Essentials Medicines), whilst the general hospitals provide a broader variety of services and drugs. Due to this high level of organization, the public sector remains the most important channel for selling drugs, constituting 73% of the total market value.

The Private Sector: The Growth of the Pharmacy Chain Stores

On the other side, the private sector is considerably more fragmented, although it represents solely 27% of the total market. It is composed of two major players:

- The independent pharmacies: there are approximately 54.000 of them, localized in almost every part of the country. Their popularity can be explained by their capacity to earn loyalty due to personalized and flexible services. They can also rely on the loyalty of the older part of the population, more used to little shops and tailored solutions.

- The retail pharmacies chain stores: there are approximately 3.000 of them, mainly gathered around the biggest cities (Hanoi and Ho Chi Minh City). They provide a wider range of different drugs, cosmetics, and healthcare products as well as different services (online platforms, foreign products, qualified pharmacist). According to our estimates, there are approximately 3.000 Modern Pharmacies.

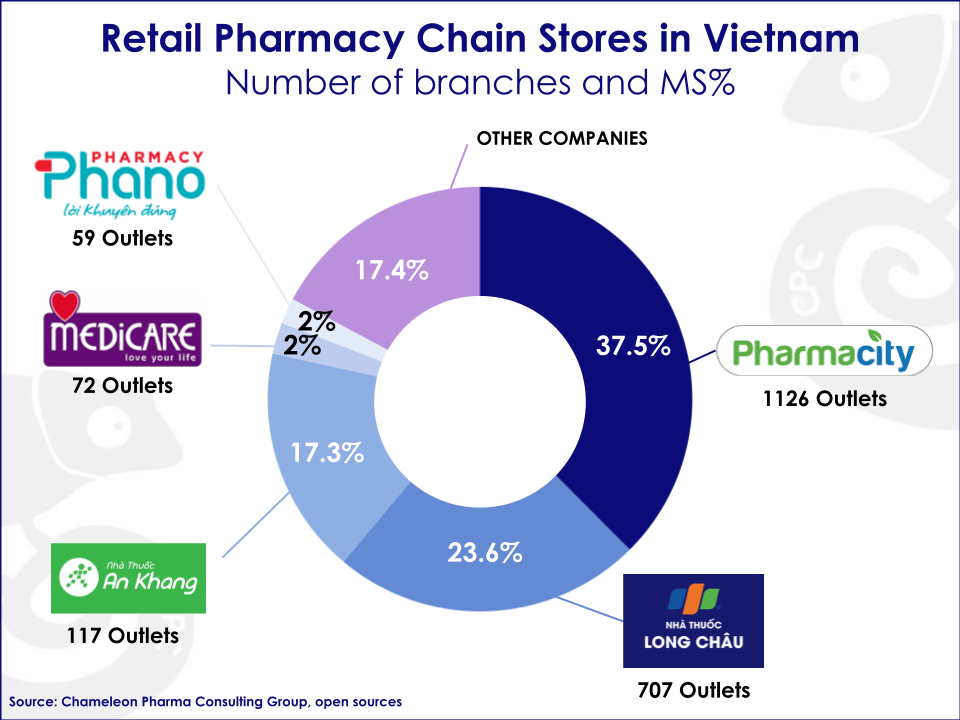

Retail Pharmacy Chain Stores in Vietnam (number of branches and MS%)

Even if the number of outlets belonging to a chain represents only 5% of the overall market at the moment, its share will grow in the coming years. Between 2019 and 2020, despite the COVID-19 crisis, the numbers of outlets have grown by 75%. This trend will continue with, for example, the market leader Pharmacity, planning to open 5.000 outlets by 2025. Retail pharmacy chain stores will take hold in the long-term, due to greater financial resources and a greater variety of products offered, especially international ones.

The fast pace of new outlet openings is a real opportunity for international OTC and Rx companies wishing to enter the Vietnamese market. Chameleon Pharma Consulting Group will support you to find the most suitable local partner with the right channels for your products through our Systematic International Partner Company Identification method. Don’t hesitate to contact us at service@chameleon-pharma.com for more information!