Photo by Claudio Schwarz on Unsplash

Germany is Europe’s largest pharma market and a global healthcare leader, known for its big market size and 100% reimbursement in the tender drug segment. Key developments like the rise of generics, AMNOG, and the DiGA program reflect its balanced approach to access, progress, and sustainability.

Generics, Rx, Originators, and Biosimilars in Germany: A Balanced Market

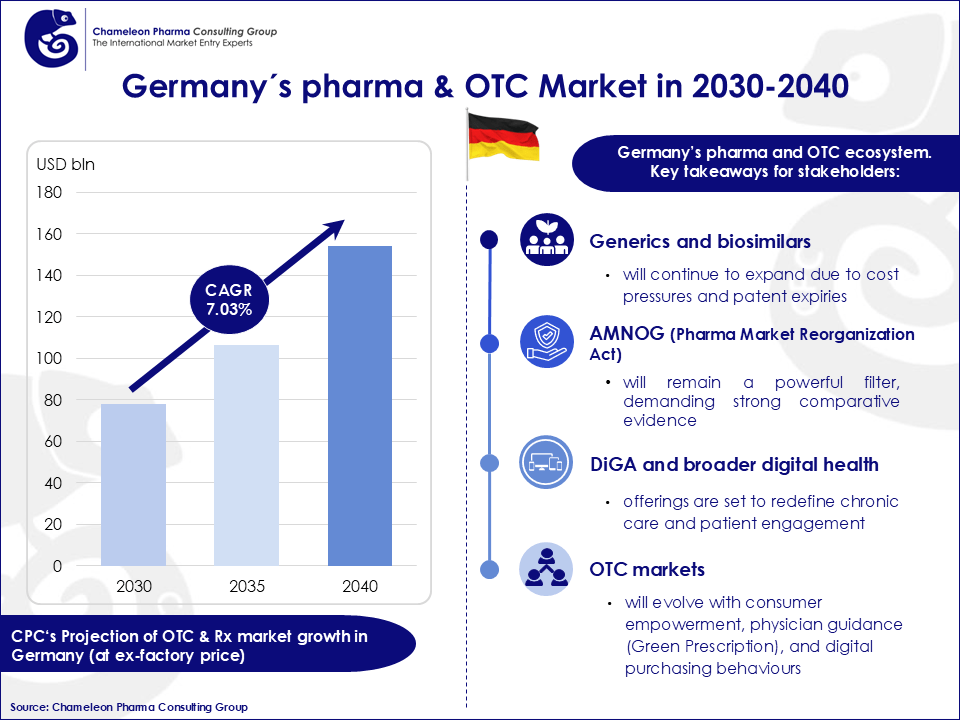

Germany’s pharma market is one of the biggest markets, projected to reach US$153.98 billion by 2040, with a CAGR of 7.03%. It operates on a dual structure of originator drugs and generic medicines, further enriched by the growing role of biosimilars and the consumer healthcare segment. Generics account for approximately 75–80% of prescriptions by volume, yet represent only 30% of pharma expenditure, underlining their crucial role in maintaining affordability.

Meanwhile, originator drugs—especially in specialized fields like oncology and immunology—continue to command higher revenue shares due to their clinical value and limited alternatives. This balance is enhanced by:

- Reference pricing (Festbetragsregelung) to encourage the use of lower-cost generics.

- Discount contracts (Rabattverträge) between insurers and manufacturers, supporting price competition.

- Incentives for physicians and structured co-payment systems that drive cost-effective prescribing.

- Emerging dominance of biosimilars, especially in biologic drug classes, expanding access to advanced therapies post-patent expiry.

Figure 1: Germany´s pharma & OTC market in 2030-2040.

AMNOG: Value-Based Market Access and Cost Control

The Pharma Market Reorganization Act (AMNOG), enacted in 2011, is Germany’s cornerstone policy for regulating the price and reimbursement of new prescription medicines. The process demands a frühe Nutzenbewertung (early benefit assessment) for all novel drugs by the G-BA (Federal Joint Committee) and IQWiG (Institute for Quality and Efficiency in Health Care), typically within the first-year post-launch.

Key AMNOG Features:

- Free Pricing for 12 Months: Manufacturers set launch prices for the first year.

- Benefit Assessment Dossier: Required for comparison with existing therapies.

- Price Negotiation: If added benefit is confirmed, a reimbursement price is negotiated with the GKV (Statutory Health Insurance Funds); otherwise, the price is reduced to reference levels.

- Orphan Drug Clause: Presumed benefit unless annual sales exceeds €30 million.

Recent reforms have tightened standards for benefit demonstration, especially for combination therapies and rare diseases, raising the importance of real-world data and comparator evidence. While AMNOG has improved cost efficiency and transparency, it has also contributed to delayed launches or market withdrawals in cases of price disagreements.

DiGA – Digital Health Applications: The Future of Prescribable Tech

Germany is a global pioneer in integrating certified digital health solutions into its statutory healthcare system via Digitale Gesundheitsanwendungen (DiGA)—prescribable medical apps reimbursed like conventional therapies.

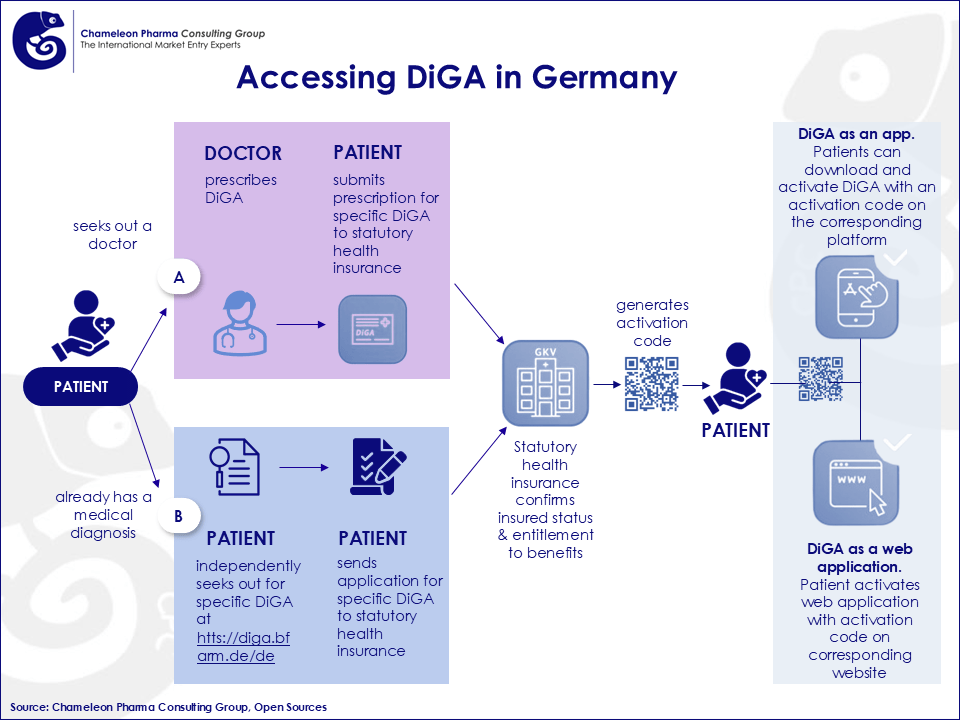

DiGA Process Overview: BfArM Application: Manufacturers submit applications through an official portal.

- Evaluation: BfArM assesses for data privacy, functionality, and evidence of positive health outcomes within three months.

- Provisional Access: If promising but incomplete, DiGAs may enter a trial phase with reimbursement.

- Price Negotiation: Final pricing is settled with the GKV post-approval.

As of 2024, more than 50 DiGAs are approved, addressing conditions such as mental health (e.g., anxiety, depression), diabetes, tinnitus, and musculoskeletal disorders. DiGAs are a pillar of Germany’s digitalization strategy, though ongoing challenges include integration into care workflows and patient adherence.

Figure 2: Access for DiGA in Germany

The Green Prescription (Grünes Rezept): Linking OTC and Medical Oversight

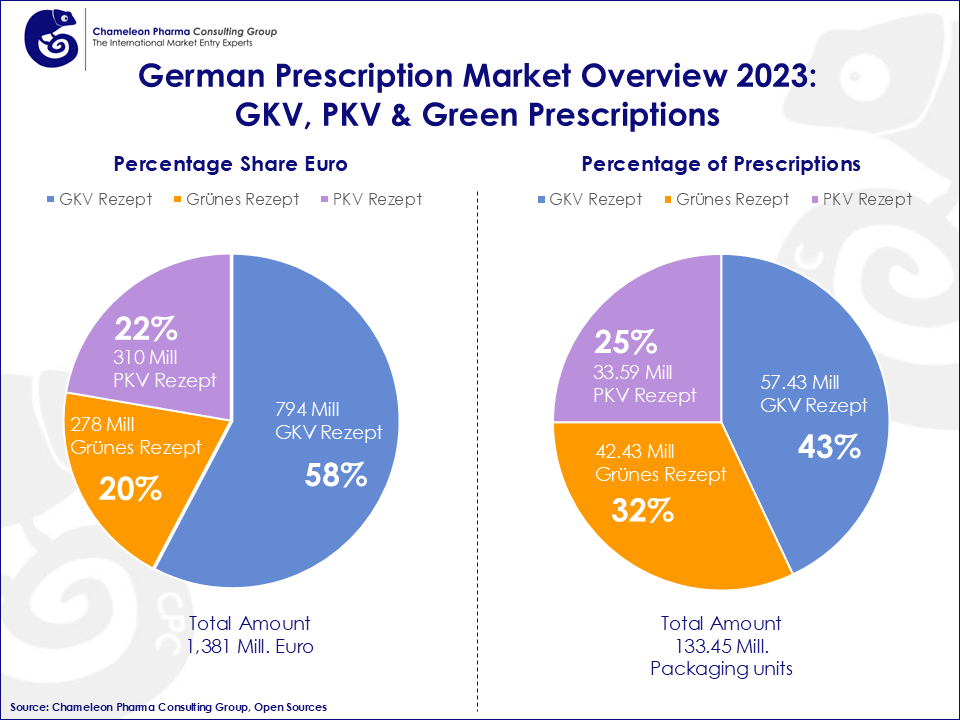

A unique feature of the German healthcare system is the Green Prescription—a non-binding physician recommendation for non-prescription (OTC) medicines. While not typically reimbursed, some sickness funds may choose to cover specific OTC items.

Benefits of the Green Prescription:

- Medical Guidance: Strengthens trust in OTC self-medication under doctor supervision.

- Market Reach: Around 60 million Green Prescriptions are issued annually.

- Reinforces Pharmacy Role: Pharmacists advise on safe and effective use, supporting the culture of Selbstmedikation (self-medication).

The Green Prescription has become an effective bridge between professional advice and patient-driven OTC usage, supporting responsible self-care and reducing the burden on the prescription system.

Figure 3: German Prescription Market Overview

How CPC could assist regarding your German market entry:

Chameleon Pharma Consulting Group (CPC) has over 20 years of experience in supporting Pharma, OTC, Medical Devices, Phyto, and Aesthetic Medicine companies. Having established own offices & local hubs across Latin America, Europe, Asia, the US/Canada, the Middle East, and the CEE/CIS regions is another advantage of CPC. With this local network and expertise gained from 300+ international projects and a team of 25 experts we offer our clients:

- Business Development, M&A, and Due Diligence

- Market Entry & Expansion: Systematic product and country analysis, market reports

- Strategic Partnering: Identifying local partners, acquisitions, or setting up own offices

- Regulatory & Registration: for drugs, MD, Derma, Aesthetic Medicine, etc.

- Market Authorization & Compliance: Holding MAs, conducting pharmacovigilance

- Quality & Certification: GMP certification, pre-GMP audits

Contact us today for your individual request at service@chameleon-pharma.com!