Photo by Hoach Le Dinh on Unsplash

Vietnam’s dietary supplement & VMS market is booming, driven by increasing consumer awareness regarding personal health, rising disposable incomes, and a growing aging population. Vietnam represents a fast-growing frontier with a highly fragmented player landscape where both local and international brands are competing for a share of this growing market. In this article, you can find information about key trends, key players, regulatory environment, and strategies for entering this dynamic Southeast Asian market.

Vietnam’s Pharma & OTC Market Overview

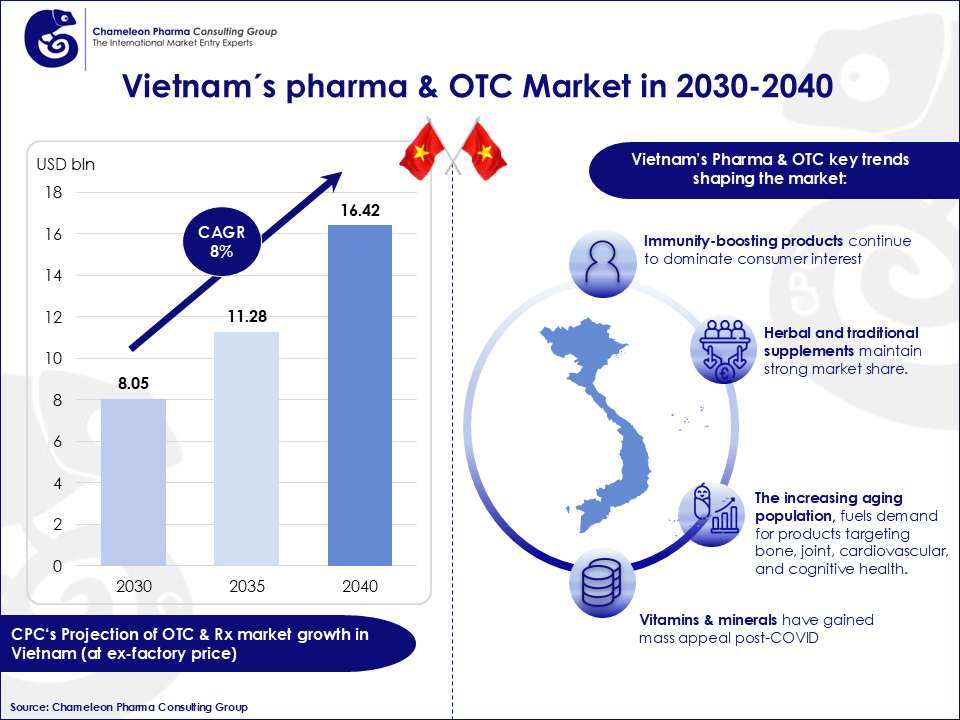

Vietnam’s pharma market is projected to reach USD 16.42 billion by 2040, expanding at an 8% CAGR. The consumer health segment accounts for approximately 25% of total pharma sales, reflecting a growing preference for self-medication and preventive care among consumers. This growth is driven by increasing healthcare expenditure, rising incidence of chronic conditions such as diabetes and cardiovascular diseases, and a consumer shift toward natural and functional products, including herbal formulations.

Independent drugstores still make up 80% of the pharmacy network, but tech-savvy consumers are embracing online health influencers, e-pharmacies, and direct-to-consumer brands.

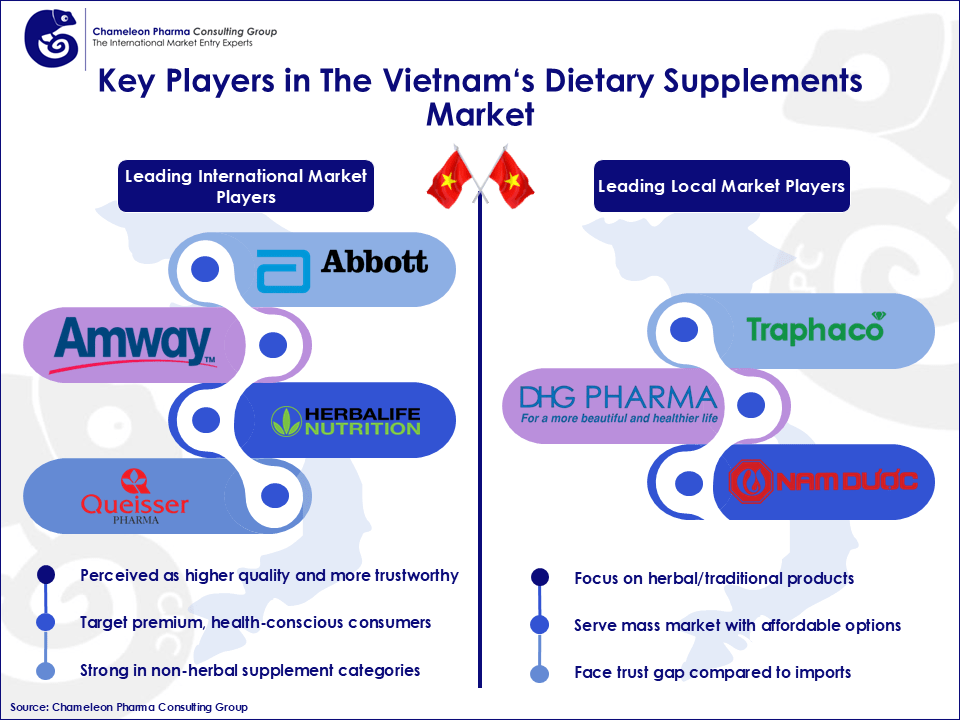

Vietnamese consumers generally trust foreign health supplements more than domestic ones, particularly in non-herbal and premium product segments. Imported products are seen as higher quality due to their stricter manufacturing standards and perceived efficacy. Local brands tend to focus on traditional and herbal remedies, which are more common in the mass market. This brand perception gives foreign companies a competitive edge, especially among health-conscious and urban consumers.

Figure 1: Overview of Vietnam’s pharma & OTC market in 2030-2040 with key trends shaping the market

Health Supplement + VMS Market Size, Growth & Trends in Vietnam

The food supplement + VMS segment is growing at an estimated 8%–13% CAGR, with our projections indicating the market could reach USD 4 billion or more by 2040. This growth is fuelled by several key trends.

Key trends shaping the market:

- Immunity-boosting products continue to dominate consumer interest, driven by lingering health concerns from the pandemic.

- Herbal and traditional supplements maintain strong market share, favoured for their perceived safety and cultural acceptance.

- The increasing aging population, fuels demand for products targeting bone, joint, cardiovascular, and cognitive health.

- Vitamins & minerals (especially C, D, and multivitamins) have gained mass appeal post-COVID, driven by widespread public interest in immunity-boosting products.

Key Players in the Vietnamese Food Supplement Market

Vietnam’s supplement market is highly competitive and fragmented. The competitive landscape includes both local manufacturers and multinational corporations:

Local Market Players:

- Traphaco JSC: A leading Vietnamese pharma and functional food company with strong heritage in herbal/traditional medicine. Traphaco is widely trusted for its locally formulated supplements.

- Hau Giang Pharma JSC (DHG Pharma): One of the largest pharma companies in Vietnam, known for its extensive portfolio of over the counter (OTC) and functional food products tailored to Vietnamese consumers.

- Nam Duoc JSC: Specializing in herbal and traditional dietary supplements, Nam Duoc is known for ingredients sourced from Vietnamese traditional medicine.

International players:

- Herbalife Nutrition: A leading US-based multinational with a broad product line in health supplements, weight management, and general wellness. Herbalife has built strong brand loyalty in Vietnam.

- Amway: Known for its Nutrilite supplement line, Amway is one of the top direct-selling supplement companies in Vietnam, offering vitamins, minerals, and herbal-based products.

- Abbott Laboratories: A trusted global healthcare company with a significant presence in Vietnam, particularly in nutritional products like Ensure and Pediasure, as well as vitamins and dietary supplements.

- Queisser Pharma: The German company behind Doppelherz, Queisser entered the Vietnamese market in 2013 through its joint venture partner, Master Tran Corporation, and now offers over 50 food supplement products across pharmacies, clinics, hospitals, supermarkets, and healthcare shops nationwide.

Figure 2: Overview of the Key Players in The Vietnam‘s Dietary Supplements Market

Vietnamese Food Supplement Regulatory Environment

Vietnam’s dietary supplement market operates under a strict regulatory framework, managed by the Vietnam Food Administration (VFA) under the Ministry of Health. Manufacturers must comply with strict safety, quality control, ingredient transparency, and accurate labelling standards. Key aspects include:

- Product registration or declaration is required before market entry, including dossiers on safety, efficacy, and intended health benefits.

- Products must be manufactured under GMP-compliant facilities, either locally or abroad.

- Labelling must be in Vietnamese, with no disease treatment claims permitted. Only approved health claims are allowed.

- Advertising is regulated and must align with documented benefits. Violations can result in fines, public recalls, and product bans.

Due to these regulations and the complexity of the registration process, foreign entrants are advised to partner with local firms for smoother market access and regulatory navigation.

Market Outlook: Food Supplement and VMS

The Vietnamese health supplement market presents compelling opportunities, particularly in herbal-based formulations, immunity-boosting products, and age-related functional nutrition. However, successful market penetration requires a deep understanding of consumer preferences, adherence to local regulations, and strategic partnerships to overcome distribution and registration barriers.

How CPC Supports Market Entry in Vietnam

Chameleon Pharma Consulting Group (CPC) has over 20 years of experience in supporting Pharma, OTC, Medical Devices, Phyto, and Aesthetic Medicine companies. Having established own offices & local hubs across Latin America, Europe, Asia, the US/Canada, the Middle East, and the CEE/CIS regions is another advantage of CPC. With this local network and expertise gained from 300+ international projects and a team of 25 experts we offer our clients:

- Market Entry & Expansion: Systematic product and country analysis, market reports

- Strategic Partnering: Identifying local partners, acquisitions, or setting up own offices

- Regulatory & Registration: for drugs, MD, Derma, Aesthetic Medicine, etc.

- Market Authorization & Compliance: Holding MAs, conducting pharmacovigilance

- Quality & Certification: GMP certification, pre-GMP audits

- Business Development, M&A, and Due Diligence

Contact us today for your individual request at service@chameleon-pharma.com!