The Russian derma and cosmetics market is highly dynamic. In 2018 Russian pharmacies sold 1,711 different cosmetic brands. Among these brands, medicinal cosmetics dominated the sales in pharmacy networks. Selective (premium) and mass market brands followed behind. Despite the majority of the products are represented by local brands, foreign brands still dominate in the premium price segment and indicate substantial sales in both in value and volume.

Challenges for the pharmacy business.

According to DSM data, the market of pharma cosmetics grew by 0.6% in 2018 in comparison to the previous years. However, in real terms, sales remained at the level of 2017. Overall, a drop in sales for all cosmetic stores, (-4% in value terms) is likely to be caused by the shift in consumer preferences towards online stores. This trend also contributes to the stagnation of sales in pharmacies in general.

Drugstores are on the rise

Regarding the main sales channels, pharmacies sold 184.9 million packages of cosmetics, which

is equal to 44.8 billion Rubles (in retail prices). A stagnation in pharmacy sales may also be associated with an implementation of a new retail format for Russia – a Drogerie store. Thus, one of the leading retailers Magnit plans to merge its pharmacy with the store “Magnit cosmetics” to increase the sales in the most popular consumer segments.

Which cosmetic products have the highest potential?

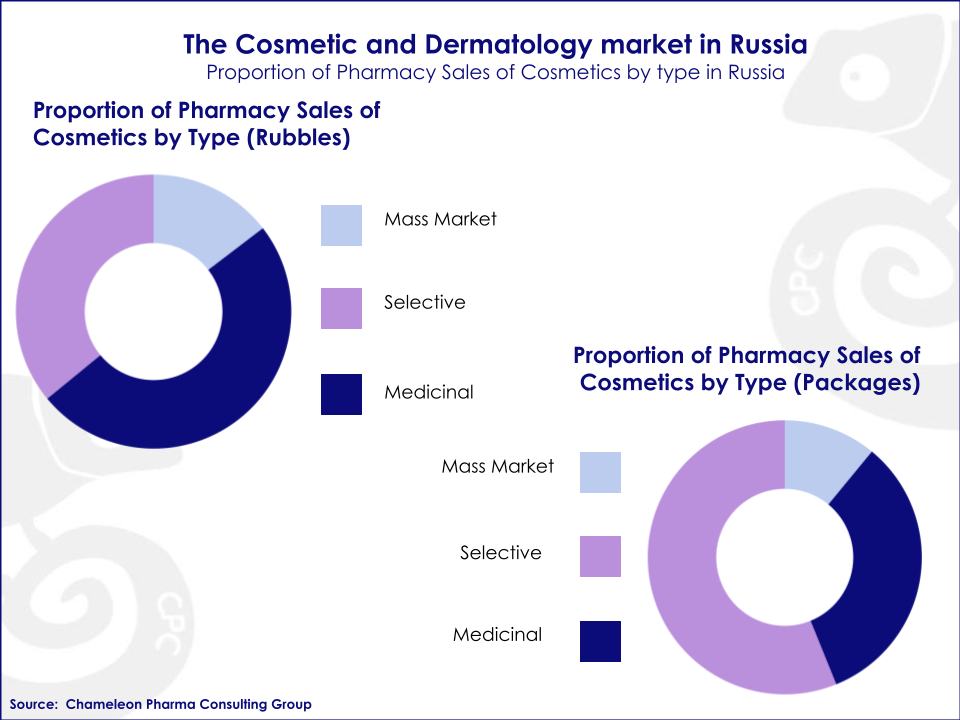

A substantial part of the cosmetic pharmacy sales is attributed to medicinal products with biologically active substances indicated for certain skin diseases. This is the most common type of cosmetics sold in pharmacies and the segment accounts for 49.5% of the market share in Rubles and 56.3% in packages.

Mass market cosmetics represent a wide range of affordable products which are usually distributed through various sales channels (Garnier, Nivea, etc.) Although, pharmacy stores are not the main priority channel for mass market cosmetics, this group is widely popular among Russians, with the share of 14.6% in Rubles and 33% in packages.

Selective (Premium and Luxury) brands provide a special and personalised care concept based on skin and hair type. A decrease in sales both in Rubles and in packages in this sub-segment is mainly caused by the increased online sales in recent years.

Market opportunities for foreign Derma products and cosmetic brands

Regarding the proportion between local and foreign products, premium and luxury cosmetics are mainly represented by imported brands (77.0% of the market in Rubles and 53.9% in packages), while medical cosmetics are mainly produced by Russian manufacturers both in terms of cost (64.3% in value and 78.5% in volume). As for the mass-market segment, the share of domestic cosmetics increased compared to previous years and compounded of 53.8% in value terms.

Domestic cosmetics stand for more than 73.7% of the sales in volume. However, when analysing sales in monetary terms, it can be noted that the market is divided in half, there is preponderance towards imported cosmetics (about 52.1% of sales). This presents good opportunities for foreign companies to enter the market, especially with premium Derma and Cosmetic products.

Information provided by DSM Group

https://dsm.ru/