To enter new international countries is a challenging and very time-consuming process in which a great deal of prior planning and evaluation is necessary. In order to make this process more transparent, this article describes a systematic approach on how to enter the most promising Pharma and Consumer Health market. The approach includes five fundamental steps:

- international own product portfolio analysis and selection,

- country analysis and selection,

- market entry planning and strategy, and finally

- the regulatory process and the local company partner selection process or other market entry possibilities.

- International Systematic Product Portfolio Analysis

The development of a solid and specific product portfolio as part of your international OTC and Pharma Strategy is of high importance, as it creates the opportunity to launch the best fitting products with the best potential across different healthcare systems.

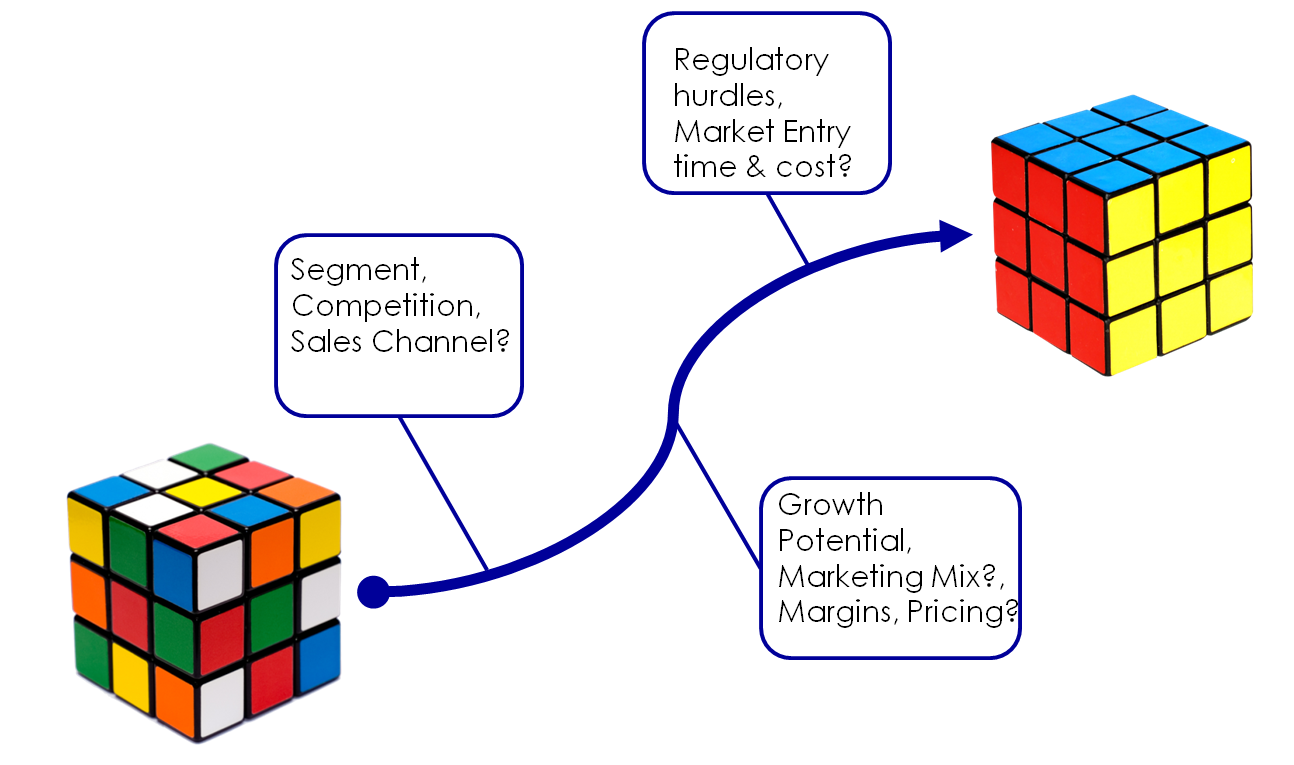

It is also of significance to analyse markets individually and beyond market data alone (e.g. IMS, DSM or Insight Health), as data can be quite misleading if it is not extensively analysed and understood with local marketing knowledge. A market may show the most rapid growth, but certain issues with respect to trademarks, registration rights, patents, high market entry costs, high regulatory cost and long registration time issues can still be present.

At this stage of your international strategy, your suggested consumer prices will be analysed based on their competitiveness in the potential markets. Furthermore, new niche segments and off label indications will be assessed based on your own products.

<< The outcome of this first step is the identification of key products that can go international to gain further revenue>>

- Systematic Country Selection

Two aspects should be considered in the selection of countries in Latin America, CIS/CEE, Middle East or Asia: BRIC does not always make sense for OTC and Pharma and success is not guaranteed there!

It is always necessary to identify the most suitable countries for your specific portfolio and to simply enter any emerging market does not automatically guarantee success. A new market entry often involves more challenges than opportunities.

- Product & Country Matrix Analysis

After conducting the Systematic Product and Country Analysis , it is advisable to bring all those parameters in a matrix in order to identify the Top 3-5 products to launch in each region within the Top 3-4 countries that show the most potential. A complex but very useful analysis to construct every 4-6 years for one of the geographical regions you are focused on e.g. Latin America, CIS/CEE, Middle East, Asia or Europe.

Here are four important considerations one should keep in mind to go further after having conducted the detailed Systematic Product and Country Analysis:

Market Entry Action Plan

A specific market entry action plan & strategy for each region / country is important in order to earn the full potential of the selected products in the specific market. Factors such as the market entry costs, regulatory time & cost, the competitive landscape and your potential in the new target market should be compared and assessed at this point.

- Regulatory

The regulatory situation has been analysed in previous steps. At this stage it is about conducting the individual registration successfully. The knowledge and understanding of each country’s regulatory entering criteria are vital when trying to enter a new market, as there are notable national differences and your product is dependent on its status, e.g. Pharma, Consumer Health, Medical Devices, Food Supplements, Cosmetics, etc.

<<We identify the right registration category and strategy, options for fast track registrations and product labelling >>

- Local Partner Company Identification and Selection Process

As with any international market success, more than 80% of the success depends on finding a suitable local partner company or your own office. Hence, a systematic search for the best fitting local partner company must be conducted as part of your global Pharma and Healthcare Strategy.

The wrong choice of a partner can result in having to change partners, which means that time, money and energy would need to be reinvested. Thanks to our experience and network, you can further save valuable time and money by avoiding “getting to know you meetings” throughout the partner selection process.

<<A screening of all available partners should be conducted to assess which company perfectly fits your requirements and product segments.>>

This systematic approach designed by CPC will result in the identification of countries that should be in focus in the next 3-5 years. You will know which countries to harvest in the coming years and which countries to enter with additional products. In a joint project with CPC you will be able to save a great deal of time and travel costs thanks to our systematic approach. You will also be able to increase your company’s value thanks to our expertise conducting structured country and product portfolio analyses, our regulatory knowledge and our unique development of a fitting market entry strategy.

How to make it happen?

We at CPC (Chameleon Pharma Consulting), are OTC & Pharma experts in the Emerging Markets and Europe with more than 20 years of experience. We can support you, whether by identifying and assessing your international portfolio or by finding your most suitable local partner. With our longstanding network and knowledge of the industry, we can assist you in the development of your international Pharma strategy, which saves you both time and money. For more details on how we operate and on specific steps, feel free to contact us anytime.

Related Posts

The Growing Saudi Arabia’s Pharma & OTC Market: Outlook to 2030-240!

Photo by Sulthan Auliya on Unsplash Saudi Arabia stands at the forefront of healthcare transformation in the Middle East, spearheading one of the...

Colombia’s Pharma Compounding Market 2040: Market Data, Regulatory Insights and What Comes Next

Photo by David Restrepo on Unsplash Colombia is fast becoming a focal point in Latin America for the growth of compounding pharmacies and...

Malaysia’s Growing Consumer Health & Pharma Market: Key Pharmacy Chains and Trends to 2040

Photo by Meriç Dağlı on Unsplash Malaysia’s self-medication and Rx market is expanding fast, according to CPC forecasts the market is projected to...