Photo by Amelia Cui on Unsplash

LATAM’s prescription drug and medical device markets are growing steadily, driven by rising demand and regulatory reform. Driven by strong healthcare demand, improved regulatory pathways, and expanding hospital infrastructure, LATAM offers fertile ground for market entry in countries like Brazil, Mexico, Colombia, and Chile.

Overview of LATAM Prescription medicine market

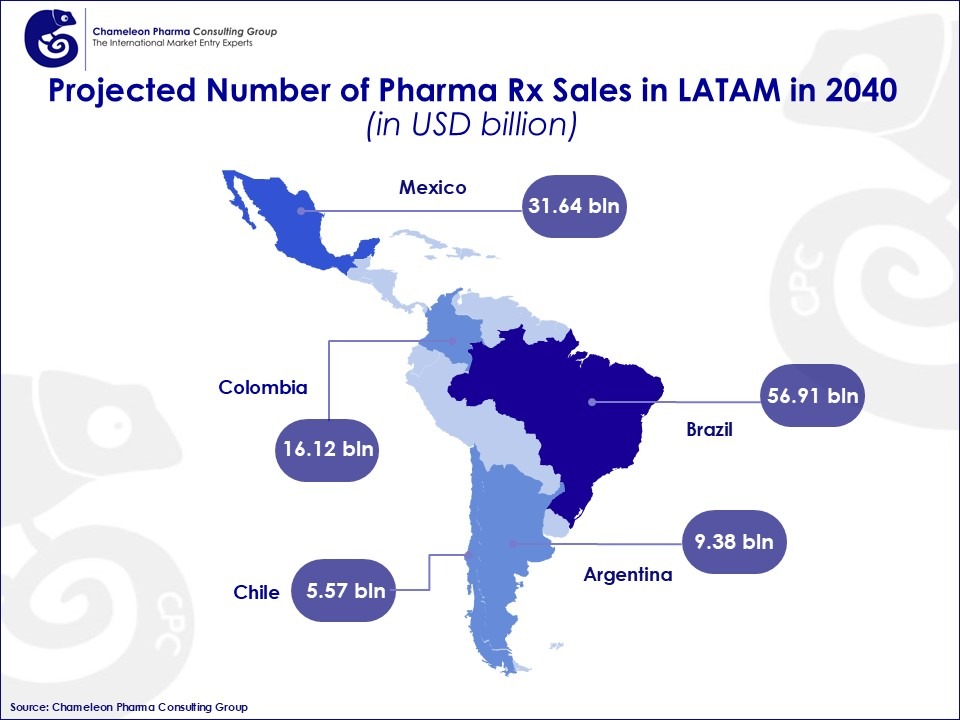

Prescription drug sales in LATAM are expected to grow at a CAGR of 7.5%, reaching USD 139.43 billion by 2040. The market remains split between originator products (holding about 40-45% share) and generics (55-60%).

Governments across the region are promoting wider access to essential treatments through price regulation and incentives for generic drug use. This trend is shaping a more accessible and cost-efficient healthcare ecosystem, driving the adoption of generic medicines and also biosimilars.

LATAM Medical Devices Market

LATAM’s medical device market is also on a steady upward trajectory, supported by infrastructure investments, increasing diagnosis rates, and the integration of digital health tools. Regulatory improvements across the region have reduced barriers to market entry, especially for firms that prioritize compliance and how might already have European MDR or a MD registration from a regularised country.

Figure 1: Projected Number of Pharma Rx Sales in LATAM in 2040

Leading countries in the Pharma Rx and Medical Devices segment in Latin America:

Brazil

Brazil alone represents the biggest share of LATAM’s prescription drugs market, with Rx sales growing from USD 26.72 billion in 2030 to USD 56.91 billion by 2040, maintaining a CAGR of 8.4%.

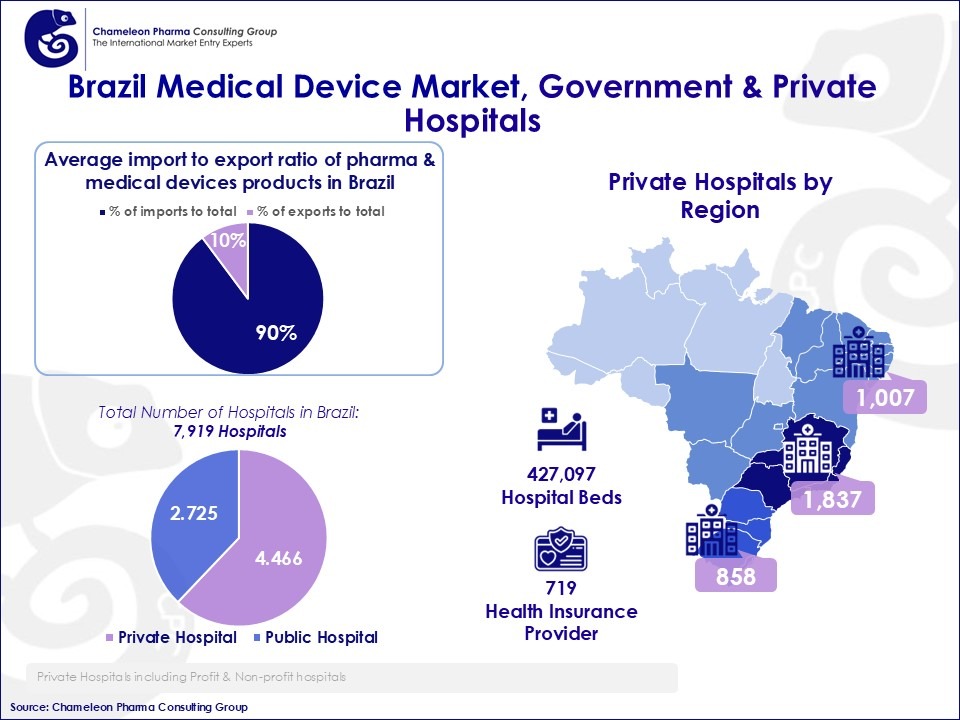

- Brazil’s pharma market is heavily import-dependent, with imports representing approximately % of the total pharma and MD trade volume.

- The total demand for Pharma Rx and MD products is surging, particularly for specialty treatments and high-end equipment.

- Although exports are growing, variability year-to-year remains high, suggesting a reliance on external supply rather than domestic manufacturing.

Figure 2: Brazil Medical Device Market, Government & Private Hospitals

Mexico

Mexico’s pharma market is projected to reach USD 39.9 billion by 2040, reflecting steady growth driven by increasing demand and regulatory stability. In addition to its pharma sector, Mexico ranks among the world’s top medical device manufacturers and exporters, with a significant portion of production destined for the U.S. market.

Moreover Mexico also offers a Fast track registration process for Pharma Rx. drugs and medical devices in less than 12 months.

Mexico’s strength in medical device exports highlights its regional leadership in manufacturing efficiency and innovation capacity. The country continues to attract foreign investment and scale up production capabilities.

Key advantages include:

- Competitive and stable manufacturing costs, ideal for high-volume production

- A well-structured classification and registration framework for medical devices

- A strong and growing presence of international companies, fostering local-global collaboration and knowledge transfer

Colombia and Chile

- Colombia’s Pharma Rx and MD markets are modernizing rapidly. The national regulatory, has implemented faster and more transparent pathways for both drugs and medical devices.

- In Chile, government reforms support faster access to generics and biosimilars, while the medical device sector benefits from streamlined registration aligned with international norms.

These trends align with the regional push for innovation and patient-centered care. For companies aiming to navigate this complex landscape, strategic regulatory knowledge is crucial. This article offers deeper insights into medical device registration in LATAM and Europe.

Future Opportunities and Strategic Recommendations in Pharma & MD

- Focus on Healthcare Infrastructure Expansion: public and private investment is strengthening healthcare networks across secondary cities, creating fresh opportunities for both prescription drugs and medical devices.

- Embrace Digital Health Synergies: technologies such as wearables, diagnostic platforms, and remote monitoring tools are becoming part of the extended care ecosystem, offering new revenue streams and patient engagement models.

- Prioritize Generics and Biosimilars: with cost containment a regional priority, companies with strong portfolios in generics and biosimilars are well-positioned to scale, especially when supported by local production or strategic partnerships

- Leverage Local and Regional Expertise: success in LATAM hinges on deep regulatory knowledge, agile market navigation, and partnerships with trusted local stakeholders. Tailored market entry strategies and compliance with national health agencies are essential.

Given these dynamics, LATAM stands out as a promising and diversified region for pharma and MD companies ready to invest in regulatory expertise, local partnerships, and innovative healthcare solutions.

Chameleon Pharma Consulting Group (CPC) has over 20 years of experience in supporting Pharma, OTC, Medical Devices, Phyto, and Aesthetic Medicine companies. Having established own offices & local hubs across Latin America, Europe, Asia, the US/Canada, the Middle East, and the CEE/CIS regions is another advantage of CPC. With this local network and expertise gained from 300+ international projects and a team of 25 experts we offer our clients:

- Business Development, M&A, and Due Diligence

- Market Entry & Expansion: Systematic product and country analysis, market reports

- Strategic Partnering: Identifying local partners, acquisitions, or setting up own offices

- Regulatory & Registration: for drugs, MD, Derma, Aesthetic Medicine, etc.

- Market Authorization & Compliance: Holding MAs, conducting pharmacovigilance

- Quality & Certification: GMP certification, pre-GMP audits

Contact us today for your individual request at service@chameleon-pharma.com!