Photo by Ansgar Scheffold on Unsplash

Germany is Europe’s largest pharma market, projected to grow to USD 153.98 billion by 2040. With 89% of the population covered by public health insurance (GKV) and a highly structured tender system, Germany offers strategic entry routes for generics, biosimilars, and selected Rx brands.

Overview of the German Market with Market Data and Forecast

Germany is Europe’s largest pharma market and the fourth largest worldwide, after the US, China and Japan. Driven by trends such as demographic change, a rise in chronic diseases and an increasing emphasis on prevention and self-medication, the pharma market is growing rapidly. The German total pharma & OTC sales are projected to expand from USD 78.04 billion in 2030 to USD 153.98 billion by 2040 with a CAGR of 7.03%.

Germany provides ready access to a stable market of healthcare consumers with a clear expenditure system. The German healthcare system is a dual system of public and private health insurance, with mandatory coverage for all residents.

Figure 1: Overview of the reimbursement market in Germany

German Health Insurance system with Public (GKV) vs Private health insurance (PKV) providers

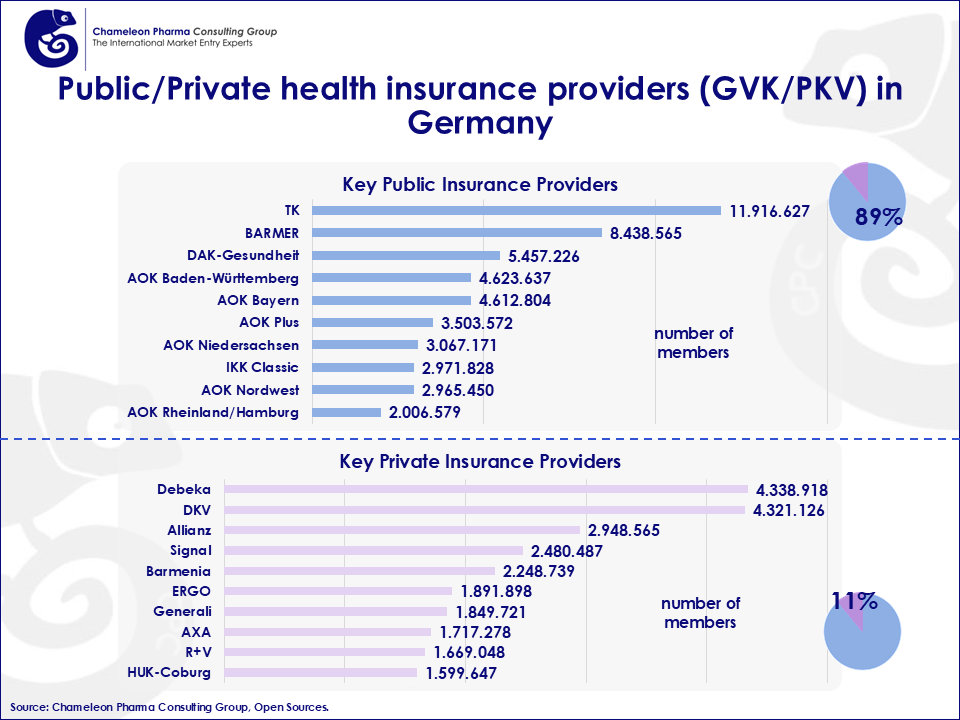

Around 89% of the German population is covered by public health insurance, making the public health insurance play the major role in the allocation of healthcare funds. Public health insurance companies are governed under the GKV-spitzenverband. An additional 11% of the population is covered by private health insurance.

Leading Public Health Insurance Funds in Germany (GKV)

- Techniker Krankenkasse (TK): One of Germany’s largest and most innovative public health insurers, known for digital services, strong customer satisfaction, and comprehensive coverage.

- BARMER: A nationwide statutory health insurance fund offering a wide range of services, preventive care programs, and a strong focus on digital healthcare and family-oriented benefits.

- DAK-Gesundheit: One of the oldest and largest statutory health funds in Germany, DAK emphasizes chronic disease management, workplace health promotion, and extensive member support.

- AOK (Allgemeine Ortskrankenkasse): One of Germany’s largest statutory health insurance funds, covering over 27 million people. Known for its strong regional presence´.

Leading Private Health Insurance Funds in Germany (PKV)

- Debeka: A major private health insurer in Germany, especially strong among civil servants and public sector workers, known for stable premiums and long-term customer relationships.

- DKV: Part of the ERGO Group, DKV is a key player in private health insurance, offering flexible tariffs and a wide range of supplemental insurance options.

- Allianz: A global insurance giant, Allianz provides premium private health insurance with tailored plans, strong international coverage, and high service standards.

Figure 2: Overview of the leading public/private health insurance providers in Germany.

Opportunities for Pharma Companies in the German Public Health Insurance (GKV) Market.

The following overview highlights key therapeutic areas by expenditure, as well as segments dominated by originator drugs, generics, and biosimilars—revealing where segment potential is the strongest.

Top 2 Indication groups in the GKV (Indikationsgruppen):

- Antineoplastics and Immunomodulators: High-cost cancer and immune therapies dominate GKV spending.

- Antidiabetics: A growing patient population and new therapies (e.g., GLP-1) fuel high costs.

Top 2 with Originalpräparate (branded drugs):

- Antineoplastics and Immunomodulators: Still heavily patented; dominated by original biologics and specialty drugs.

- Antidiabetics: Innovative brands remain strong, particularly newer injectable and oral options.

Top 2 with Generika (generic drugs):

- Lipid Modifying Agents: Statins and related drugs are widely off-patent and cost-effective.

- Antihypertensives: Broad generic availability keeps treatment of hypertension affordable.

Top 2 with Biosimilars:

- Antineoplastics and Immunomodulators: Biosimilar adoption rising, especially in oncology and rheumatology.

- Immunosuppressants: Cost-saving biosimilars are gaining traction post-patent expiry.

Pharma Procurement via Tenders (Ausschreibungen) in Germany

In Germany, statutory health insurers (GKV) procure many Rx drugs through tender procedures (Ausschreibungen) to reduce costs. These tenders are primarily used for generic drugs and biosimilars, not patented medications.

How it works:

Health insurers publish tenders for specific active ingredients. Pharma companies submit bids, usually offering lower prices in exchange for exclusive or preferred supply agreements. Contracts typically run for 1–2 years. There are various tenders held regularly by different health insurance funds, each with its own conditions, timelines, and target substances.

Figure 3: Comparison of open house vs closed tender procedures in Germany.

Open vs. Closed Tenders main differentiation:

- Open Tenders (Offene Ausschreibungen): Multiple companies can be awarded contracts. Every eligible company can submit their bid.

- Closed Tenders (Exklusive oder Exklusivausschreibungen): Only certain companies are invited to submit their offer. One or a few suppliers are selected exclusively.

Key Points for Pharma Companies:

- Competitive pricing is critical to win. However, other factors also contribute to overall success.

- Guaranteed supply reliability is important in order to avoid tender penalty.

- Winning a tender can lead to a major market share boost, especially in closed & exclusive models.

Learn more about regulations on the German value chain, margin structure, as well as strategic pricing in our next article!

Chameleon Pharma Consulting Group (CPC) has over 20 years of experience in supporting Pharma, OTC, Medical Devices, Phyto, and Aesthetic Medicine companies. Having established own offices & local hubs across Latin America, Europe, Asia, the US/Canada, the Middle East, and the CEE/CIS regions is another advantage of CPC. With this local network and expertise gained from 300+ international projects and a team of 25 experts we offer our clients:

- Business Development, M&A, and Due Diligence

- Market Entry & Expansion: Systematic product and country analysis, market reports

- Strategic Partnering: Identifying local partners, acquisitions, or setting up own offices

- Regulatory & Registration: for drugs, MD, Derma, Aesthetic Medicine, etc.

- Market Authorization & Compliance: Holding MAs, conducting pharmacovigilance

- Quality & Certification: GMP certification, pre-GMP audits

Contact us today for your individual request at service@chameleon-pharma.com!